Following the publication of Provisional Measure No 1,182, sports betting is now a regulated activity in Brazil.

Despite it being the law of the land, the PM still needs to be approved by the country’s National Congress within the required 120-period. Therefore, it may be subject to further amendments.

According to Luiz Felipe Maia, founding partner of Brazilian law firm Maia Yoshiyasu Advogados, some of the regulations have faced criticism from operators.

Criticisms include:

- The tax rate being higher than expected

- Ambiguous payment rules

- Regulatory risk for operators

“The reactions [to the PM] are 99% negative,” says Maia.

“This is because of the taxation, because of the restrictions – but mostly because of the taxation.”

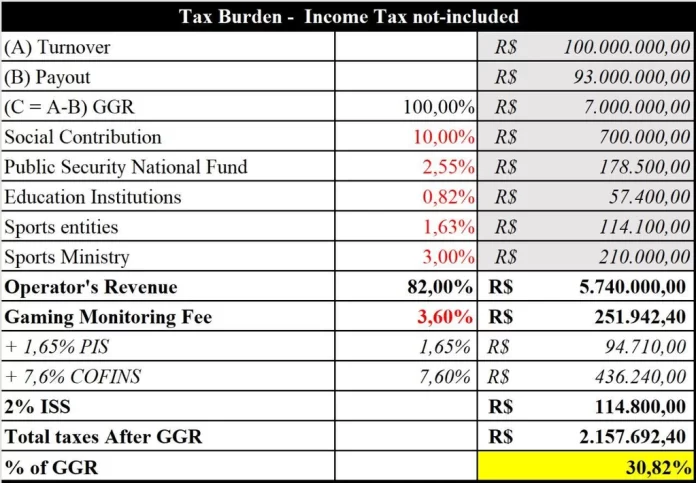

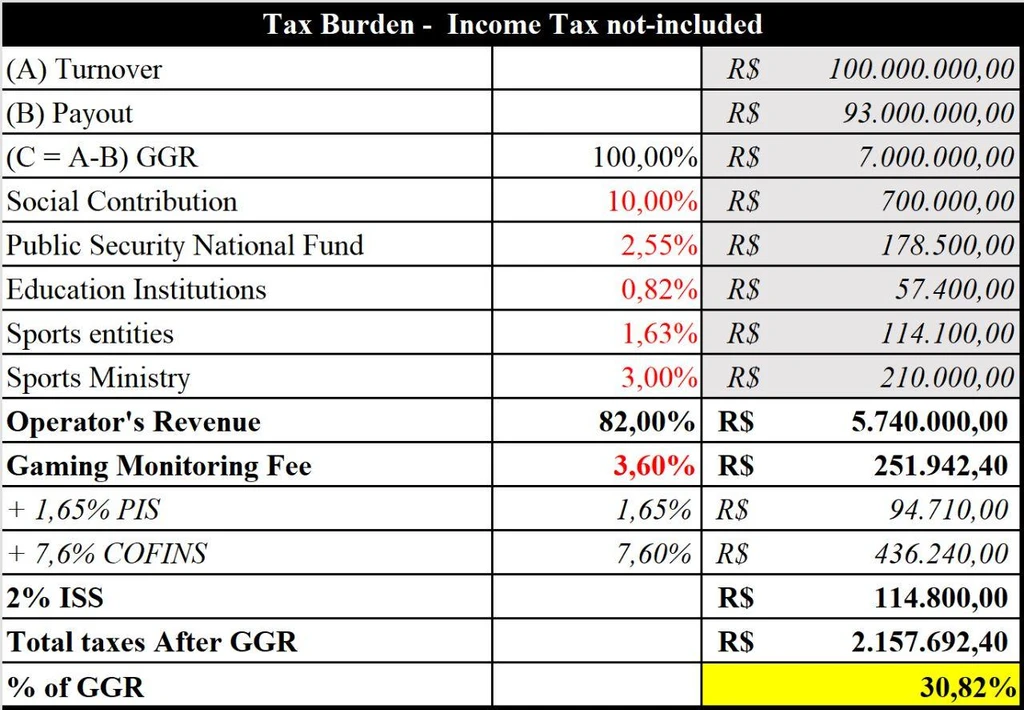

Operators to face up to 30.82% tax rate

While the headline tax rate published in the PM was 18%, this increases to a 30.82% tax on gross gaming revenue (GGR) once additional applicable taxes, such as PIS, Gaming Monitoring Fee, COFINS and ISS, are considered.

Additionally, winnings above R$2,112 (£345.30/€402.60/$444.50) are subject to up to 30% tax on winnings. This regulation pre-dates the PM.

“I was very frustrated to see that they didn’t change the taxation on winnings,” says Maia.

Maia emphasises that the taxation rate is higher than in previous drafts of the regulations.

“This one is much worse,” he says. “The older drafts understood that the ideal taxation level would be something around 20%, and not above 30%.”

Ambiguous payment rules

Maia also questioned how payments will work in the new regime.

At present, the Central Bank of Brazil sets the same payment codes for sports betting as other verticals such as poker and casino games, which all have very different kinds of regulation.

For example, poker is a game of skill in Brazil and is therefore legal, while online casino operates in a grey market environment.

Since the PM imposes restrictions on sports betting payments, there are unanswered questions about how exactly these can be done.

“If the central bank imposes restrictions on the [sports betting] transaction based on the code, they will affect poker operators as well,” says Maia.

“We don’t know if the central bank will create any specific code for a sports betting or if they will allow other gaming services to be paid with a different code.”

Operators face unintentional regulatory risk

Observers have also decried confusing rules about how operators should seek to enter the market.

Article 35C of the PM lists the circumstances in which the regulator may impose penalties on operators for violating the law.

These include operating and advertising a sports betting site without prior authorisation from the Ministry of Finance.

Punishments for breaching these regulations can include fines and a ban from receiving a licence.

Since sports betting has long been tolerated in Brazil under a grey market framework, the PM includes a clause stating that this is enforceable only after the Ministry of Finance opens applications for licences.

“The problem is there is a gap between this and the start of operations,” says Maia.

“Unless the Minister defines it, they change it in the Congress or the Minister of Finance defines it, then we will have a gap. And if the operators continue operating during this gap, they could be subject to penalties.”

Amending the PM in the Congress

As mentioned, the PM has 120 days to be approved or denied by the Congress. During this time the measure will be subject to amendment.

Maia believes it is of vital importance to use this period to solve the PM’s problems.

“At the end of the day, we end up with a market that is not very attractive from the regulatory perspective and from the tax perspective, because the taxation is very high.”

Overall, Maia believes that the PM’s publication is a positive development. But he also believes it is vital that these issues are solved soon.

“There’s a lot of work to be done with the Congress to amend this Provisional Measure and make it something feasible for the industry.”

Original article: https://igamingbusiness.com/legal-compliance/industry-reacts-negatively-to-brazil-regulations-cites-tax-rise/