Since it has historically been very difficult for wagering operators to differentiate on product over the long term, we believe that the dominant US operators will be those that can acquire customers for the lowest cost.

Multiple US-only operators have rapidly reduced their marketing activities, with a stronger focus on profitability. In contrast, operators with scale in their non-US businesses, such as Flutter and 888 Holdings, are able to fund their US marketing through the profits of global operations.

For example, in 2021, Flutter delivered group EBITDA of $1.23bn (£1.02bn/€1.18bn), including a $300m EBITDA loss in the US. In contrast, DraftKings (a US-only operator) lost $676m and will continue to require capital injections. Considering the current valuations of high growth businesses, this is likely to be very dilutive for existing shareholders.

Churchill Downs is a recent example of a company that has not only reduced its marketing activities but also decided to completely exit the sportsbook business in February.

“The online sports betting and online casino space is highly competitive with an ever-increasing number of participants… Many are pursuing maximum market share in every state with limited regard for short-term or potentially even long-term profitability,” said Churchill Downs’ CEO, William Carstanjen.

The benefits of scale in gaming and wagering are not limited to B2C. While we focus on the most innovative smaller B2B suppliers globally (such as Voxbet), there are some segments of the industry that require significant scale to succeed.

Growth of live casino

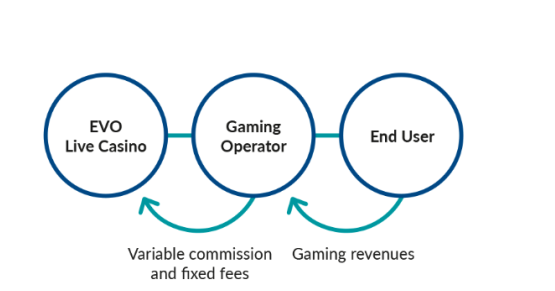

One of the segments that requires scale is live casino. In live casino, a casino game (such as poker or blackjack) is shown via a live streaming video link, in real time from a casino table. Live casino suppliers then sell this product to operators like Flutter and DraftKings.

The first live casinos were launched in the mid-2000s, with the segment growing rapidly after the introduction of smartphones and technological advances in streaming and text/voice chat functionality. The global live casino segment continues to grow rapidly at +31% per annum, compared to +15% for RNG (random number generator) games and an 8% decline for land-based casinos (according to the Times of Malta). We believe that live casino will remain one of the fastest growing segments of gaming and wagering as technology and the quality of the player experience continue to advance.

The Evolution continues

Swedish-listed Evolution (STO: EVO) operates two business segments: Live Casino and RNG. In Q1 of this year, Evolution’s live segment generated €264.5m of revenue (growth of +44% per annum), while the RNG segment generated €62.3m (growth of +1.8%). The €19bn company counts nearly all large igaming operators as clients, with revenue split between 7% Nordics, 7% UK, 33% rest of Europe, 32% Asia, 11% North America and 10% other. There are 41 live casino suppliers globally, with Evolution dominating the segment with around a 70% market share.

The challenges of live casino include live streaming globally without latency, remaining at the forefront of technological advances, continual training of on-camera staff, building complex multi-purpose studios, maintaining customer support and chat moderation across many languages, risk and surveillance.(Listen to Evolution’s Chief Product Officer, Todd Haushalter, discuss “Why is Live Casino so hard?” here). By overcoming these challenges on a daily basis, Evolution has built a significant lead over its competitors.

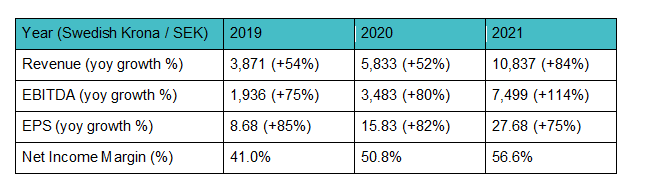

Evolution is one of the highest quality suppliers in the industry. We have spoken with many Evolution customers who say that the company is industry-leading in terms of product quality in both live casino and RNG. Evolution’s superior product and level of service have driven the company’s extraordinary revenue and profit growth.

Live casino is an incredibly high margin business at scale because while fixed studio costs are high, variable costs to support an additional player are minimal. For example, thanks to multiplayer scalability, Evolution’s ‘Lightning Roulette’ live casino product can be played by a virtually unlimited number of concurrent players.

Consequently, Evolution’s EBITDA margin has increased from 45.3% in Q1 2019 to 70.3% in Q1 2022. As Evolution grows in the burgeoning North America market, the business should benefit from significant economies of scale and margin expansion in that geography.

In 2021, Evolution’s business in North America generated €114.5m of revenue, contributing 10.7% of group revenue. Evolution has seven studios in Europe, three in the USA and one in Canada. During 2022, two additional studios are set to be launched in Europe as well as one new studio in Connecticut, USA. The business is rapidly growing at 70% per annum in North America. Evolution is a core holding in our portfolio, exemplifying our focus on high quality B2B suppliers.

All the best,

Tom

Since inception in August 2019, Waterhouse VC has achieved a total return of 1,997% as at 31 May 2022, assuming the reinvestment of all distributions.

Please note the above information in relation to Flutter, 888 Holdings, Churchill Downs, DraftKings, Voxbet and Evolution is based on publicly available information in relation to the company and should not be considered nor construed as financial product advice. Waterhouse VC has a position in Flutter, 888 Holdings, Voxbet and Evolution. The information provided in this document is general information only and does not constitute investment or other advice. Readers should consult and rely on professional investment advice specific to their individual circumstances.

Original article: https://igamingbusiness.com/taking-the-scale-war-to-b2b/