A

GS reported Thursday its financial results for the second quarter of 2021. According to its publication, the report’s highlights are:

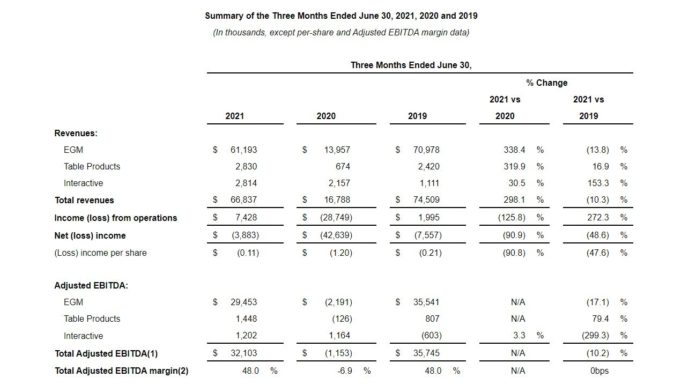

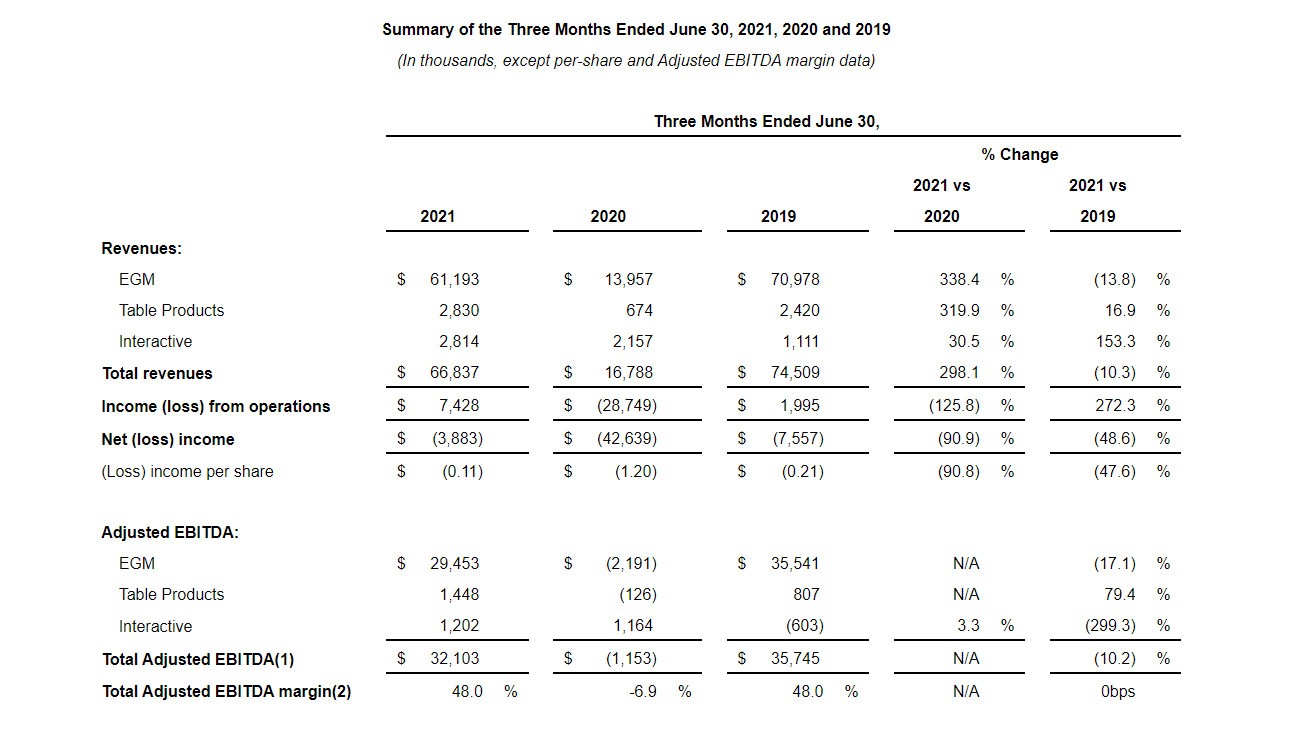

- Consolidated revenue totaled $66.8 million, up 298% compared to $16.8 million and $74.5 million in Q2 2020 and Q2 2019, respectively.

- Gaming operations, or recurring revenue, reached a record $55.0 million versus $10.2 million and $53.6 million in Q2 2020 and Q2 2019, respectively.

- An improvement in net loss up to $3.9 million, compared to $7.8 million in Q1 2021.

- Adjusted EBITDA totaled $32.1 million, up more than 20% over the first quarter of the year.

- Domestic EGM RPD and Domestic Gaming Operations Revenue established new company records.

- Orion Starwall footprint grew to over 530 games at quarter end.

- Table products Adjusted EBITDA reached a new quarterly record of $1.4 million.

- Interactive real money gaming revenue more than doubled to a record of $2.2 million.

- Generated over $14 million of free cash flow YTD, nearly $120 million of available liquidity as of June 30 2021

- International gaming operations revenue totaled $3.5 million compared to approximately $0 in Q2 2020 and $6.4 million in Q2 2019.

In an official press release, AGS President and CEO David Lopez spoke about the company’s financial results for the second quarter of the calendar year and reflected.

“We were able to leverage our over 15,000 unit domestic EGM installed base, our growing premium game footprint, and the revenue strength witnessed throughout the domestic gaming market to establish new Company records in both domestic EGM revenue per day, and domestic EGM gaming operations revenue in the second quarter”, he said. “Our improved execution and accelerating product momentum across all three of our business segments position us to deliver additional growth and share taking in the coming quarters”.

Kimo Akiona, AGS’ Chief Financial Officer, added “the continuous improvement being achieved as a result of our enhanced game content development execution, upgraded product management capabilities, and refined capital deployment processes, sets us on a path to deliver more consistent financial performance, improving our capital returns and leverage profile, and, most importantly, strengthening shareholder value over time.”

Original article: https://www.yogonet.com/international//noticias/2021/08/06/58722-ags-sets-new-records-in-domestic-egm-revenue-per-day-and-gaming-operations