Effective Oct. 1

B

ally’s has completed its £2 billion ($2.69 billion) merger with Gamesys, announced both companies Friday. A court had sanctioned the scheme at a hearing on Thursday: following delivery of a copy of said order to the Register of Companies, it has now become effective in accordance with its terms.

As a result, the entire issued and to be issued ordinary share capital of Gamesys is now owned by Bally’s and Premier Entertainment, an indirect wholly-owned subsidiary. The boards of Gamesys and Bally’s first announced that they had agreed to the terms of a recommended combination on April 13.

Under said terms, Bally’s and Premier Entertainment were set to pay $25.77 per Gamesys share. The deal was approved by shareholders in June and afterward received regulatory approval from the Great Britain Gambling Commission, with US regulatory approval and the final sign-off from the court in order to complete still pending.

The acquisition aligns with the expected closing for Q4, previously announced in May. Applications have been made to the Financial Conduct Authority and the London Stock Exchange in relation to the de-listing of Gamesys shares, which is expected to take place on October 4, 8:00 a.m. The new Bally’s shares will be listed shortly after, at 9:30 a.m., on the same day.

As the scheme has now become effective, non-executive directors Neil Goulden, Andria Vidler, Colin Sturgeon, Nigel Brewster, James Ryan and Katie Vanneck-Smith have resigned and stepped down from the Gamesys board as of last Friday.

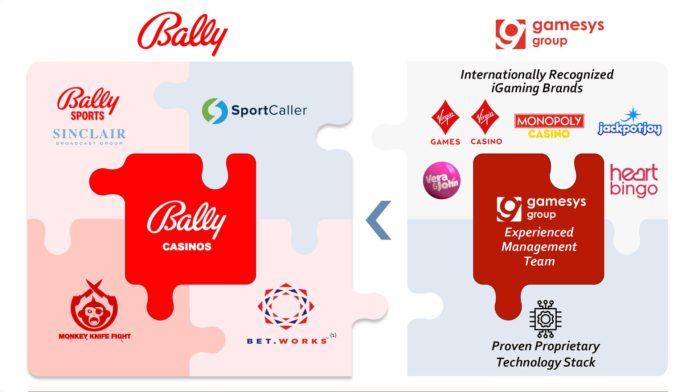

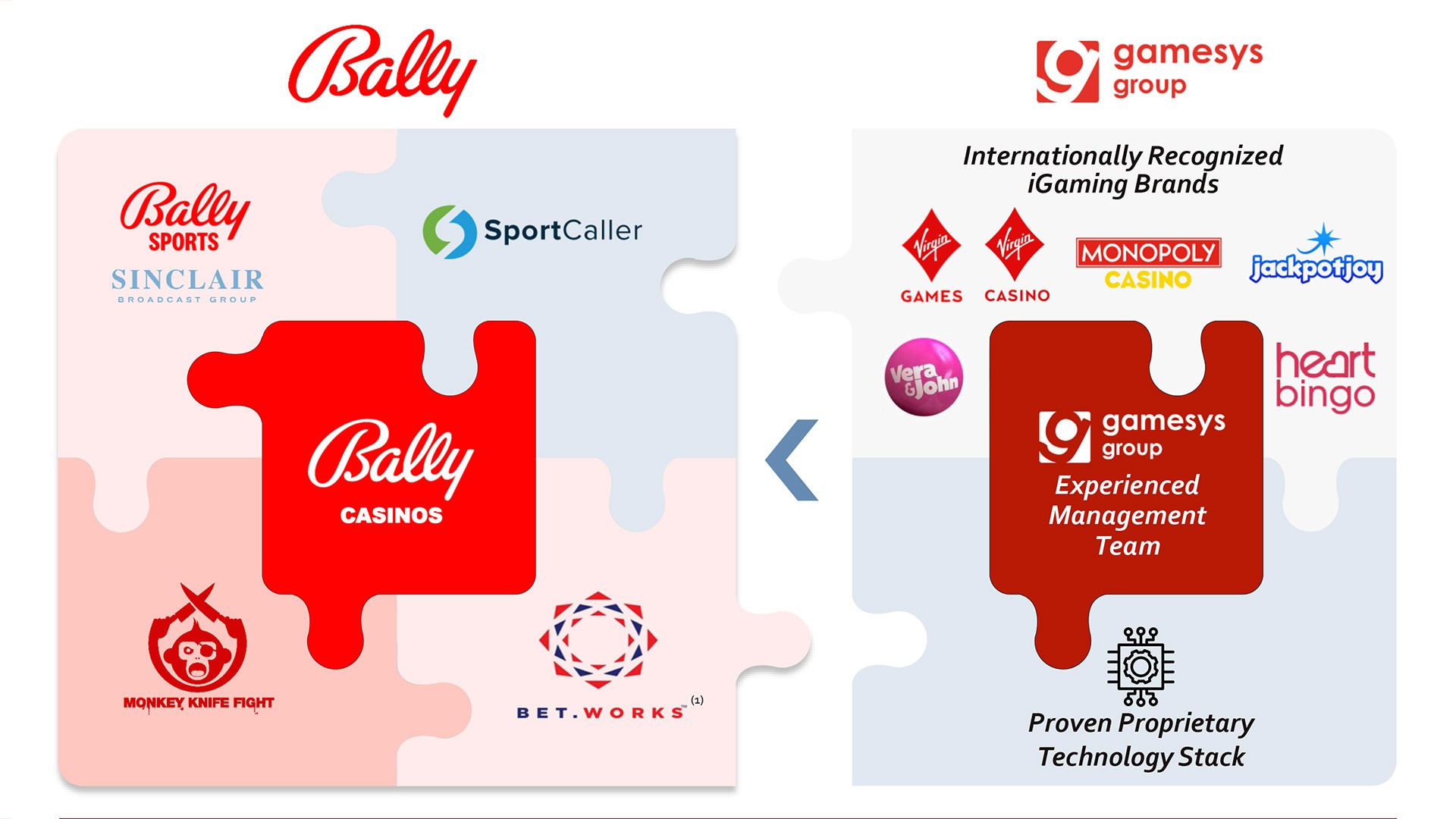

The combined entity is expected to be well-positioned to capitalize on the full range of opportunities available both in the US and abroad, stated Bally’s in a September acquisition update.

Gamesys would benefit from Bally’s land-based and online platform in the U.S., providing market access through Bally’s operations in key states as the nascent iGaming and sports betting opportunities develop in the country. In turn, Bally’s would benefit from Gamesys’ technology platform, expertise and management teams across the online gaming field.

“By combining with Gamesys, we will meaningfully accelerate our growth strategy to become a premier, global, omni-channel gaming company, which we believe will create significant long-term shareholder value,” said Soo Kim, Chairman of Bally’s Corporation’s Board of Directors on July.

“Given our comprehensive suite of collective assets and our track record of successfully developing online gaming operations in highly-competitive markets, we believe we will be able to offer customers a unique and differentiated approach to gaming,” said Lee Fenton, Gamesys’ Chief Executive Officer, the same month.

Original article: https://www.yogonet.com/international//noticias/2021/10/01/59577-ballys-completes-27-billion-merger-with-gamesys