Gaming and hospitality company Bally’s Corporation has named Bobby Lavan new Chief Financial Officer. Lavan will take over the role from Steve Capp, Bally’s current CFO, who is leaving the business “to pursue other interests and opportunities.” Capp will continue to support the company “through the end of April,” according to a press release.

Lavan has been Senior Vice President, Finance & Investor Relations of Bally’s since May 2021. In this role, he led the acquisition, financing and integration of London-based online software developer and gaming business Gamesys, completed in October last year, as well as the internal and external reporting processes.

Prior to joining Bally’s, Lavan was Chief Financial Officer of NYSE-listed Turning Point Brands. Under this role, he executed multiple international acquisitions, complex systems integration and streamlining reporting analytics.

Additionally, the executive also worked as Chief Financial Officer of electronics retailer General Wireless Operations, prior to joining Turning Point Brands, and has held “various analyst and portfolio manager roles” on Wall Street. Lavan has a B.S. in Engineering from the University of Pennsylvania.

“Bobby’s track record leading successful M&A and integration initiatives will be invaluable in helping us grow the business and accomplish our long-term financial goals,” said Bally’s Chief Executive Officer, Lee Fenton. “I am excited to work with Bobby on the Gamesys integration, streamlining our financial reporting, and executing our broader financial strategy to create further shareholder value.”

Lavan’s appointment as Bally’s new Chief Financial Officer is subject to receipt of customary regulatory approvals. “I look forward to working with Lee and the team to continue our transformation into a global omni-channel gaming leader,” Lavan commented on his appointment.

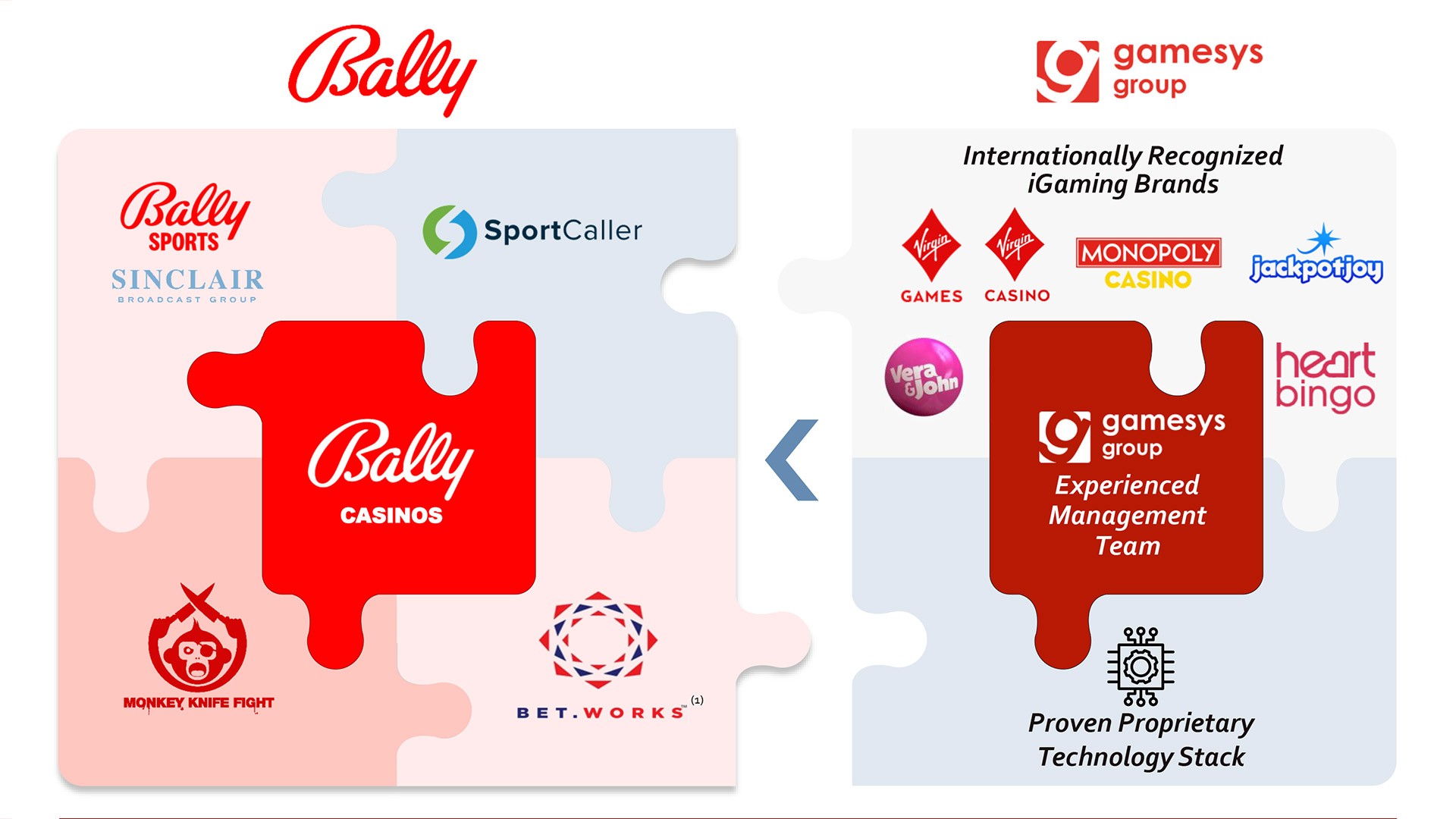

The $2.7 billion acquisition of Gamesys, completed last year, is set to permit Bally’s to extend this omni-channel strategy. The combined entity is expected to be well-positioned to capitalize on the full range of opportunities available both in the US and abroad, according to the business.

Gamesys would benefit from Bally’s land-based and online platform in the U.S., providing market access through Bally’s operations in key states as the nascent iGaming and sports betting opportunities develop in the country. In turn, Bally’s would benefit from Gamesys’ technology platform, expertise and management teams across the online gaming field.

Last month, Bally’s posted revenue of $547.7 million for Q4 of 2021, an increase of $429.6 million, or 463% compared to the same period of 2020. However, the company saw a net loss of $115.3 million compared to net income of $20.2 million for the comparable period.

These results, adjusted to extinguish debt and costs related to mergers and acquisitions, missed Wall Street expectations, reported the Associated Press. For the full 2021 year, the company reported that its loss widened to $71.8 million, or $1.45 per share, and revenue was reported at $1.32 billion.

Bally’s board of directors last month formed a special committee of independent and disinterested directors, authorized to evaluate the preliminary, non-binding proposal, dated January 25, by Standard General to acquire all of the outstanding shares of Bally’s that it does not already own for $38 in cash per share, as well as any potential strategic alternatives to the proposal. The deal values the company at about $2.07 billion.

New York-based investment firm Standard General, which already owns a 21% majority stake in Bally’s, submitted a letter to Bally’s board detailing the offer to buy the remaining stock. The proposal letter has Bally’s Chairman Soo Kim’s signature, who is also the founder and managing partner of Standard General.

Original article: https://www.yogonet.com/international/news/2022/03/14/61771-bally-39s-names-bobby-lavan-new-cfo-amid-growth-plans–gamesys-integration