Online sports betting operator PlayUpis set to go public on NASDAQ through a special purpose acquisition (SPAC) merger with IG Acquisition Corp (IGAC). PlayUp will list on the NASDAQ via a newly-formed Irish company. The deal values PlayUP at $350 million and is expected to close in the first quarter of 2023.

In a press release, IGAC said that it spent nearly two years looking for acquisition targets before settling on PlayUp – and that IGAC’s regulatory experience combined with the operator’s technological platform would create a “compelling” partnership.

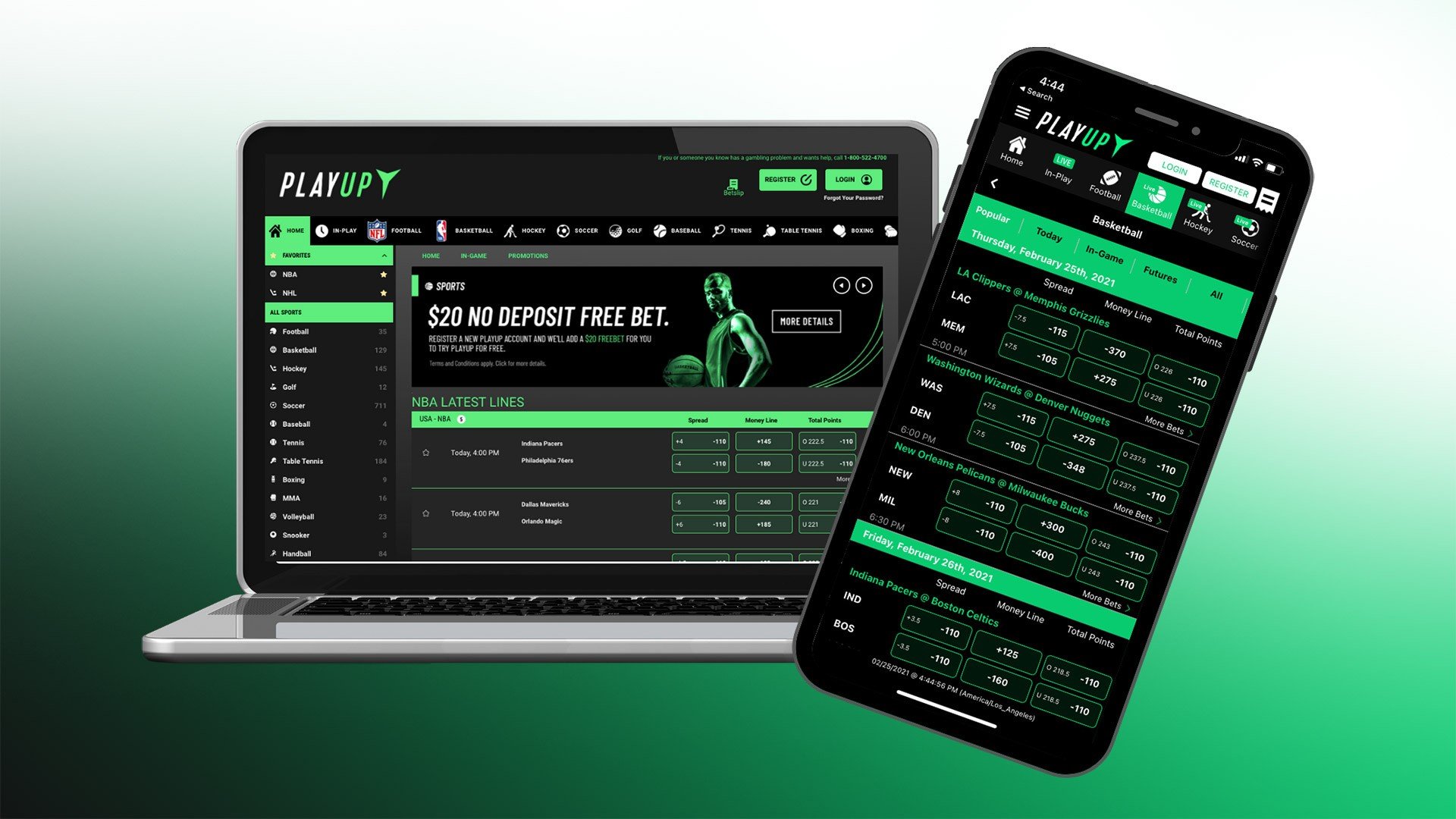

Christian Goode, Chief Executive Officer of IGAC, said: “Currently, there is no platform that allows consumers to access every type of betting product through one single sign-on. Generally, industry competitors have chosen to focus on one product or another.”

Christian Goode, Chief Executive Officer of IGAC, said: “Currently, there is no platform that allows consumers to access every type of betting product through one single sign-on. Generally, industry competitors have chosen to focus on one product or another.”

“IGAC and PlayUp have the same shared vision: to bring the global online betting industry the most comprehensive suite of traditional and innovative betting products from all over the globe together into one app. The transaction is expected to provide PlayUp with access to fresh capital to continue expanding its vision of a true single destination for the future of online betting,” the CEO added.

Christian Goode

For his part, Daniel Simic, CEO of PlayUp Limited, stated: “PlayUp believes this transaction will enable us to continue investing in our proprietary technology and deliver on our aspirations to be the unrivaled entertainment and betting platform of the future.”

“We envision a world where our players can enhance their experience betting on the products they already love plus interact with the next generation of immersive betting products that embrace newer technologies such as AR and VR,” he further commented.

Daniel Simic

As part of the transaction, Daniel Simic will retain the title of Global CEO of the combined company. Industry veterans Bradley Tusk, Chairman of IGAC, and Christian Goode, Chief Executive Officer of IGAC, will join the new combined company. Tusk will become Chairman of the combined company’s Board and Goode will serve as President of PlayUp’s U.S. business.

“We are excited about this transaction because we believe PlayUp is the closest to achieving our shared vision for the future of online betting – a platform that offers consumers any type of digital betting they want, from one app and one digital wallet, anywhere in the world where it’s legal,” said Bradley Tusk, Chairman of IGAC.

Bradley Tusk

The transaction was unanimously approved by the IGAC board of directors and unanimously approved by the board of directors of PlayUp. The transaction is expected to close in the first quarter of 2023, subject to the satisfaction of customary closing conditions, including the approval of the shareholders of PlayUp Limited and the stockholders of IGAC, and regulatory approvals.

PlayUp holds online betting licenses in multiple jurisdictions and currently operates in Australia, New Zealand, and India. Additionally, the company has sports betting operations in Colorado, New Jersey, Indiana, and Iowa and has a pending application in Ohio.

The news follows PlayUp’s July announcement that it had entered into a strategic review to consider “alternatives” to its strategy at the time – including the potential sale of the business. The operator has had a complicated history with acquisitions; the business’ planned sale to cryptocurrency exchange FTX collapsed in 2020. Leadership blamed then-US CEO, Laila Mintas, claiming she contacted FTX CEO Sam Bankman-Fried and told him that PlayUp was “not clean” and had “systemic issues”, following a dispute with her employer.

The incident led to PlayUp filing a restraining order against Mintas in Nevada court. However, the order was later overturned – with the US Ninth Circuit Court of Appeals upholding the lower court’s judgment that PlayUp had not proven “the likelihood of success on the merits” when the case itself is judged.

Original article: https://www.yogonet.com/international/news/2022/09/23/64356-playup-to-go-public-on-nasdaq-via-spac-merger-company-valued-at–350m