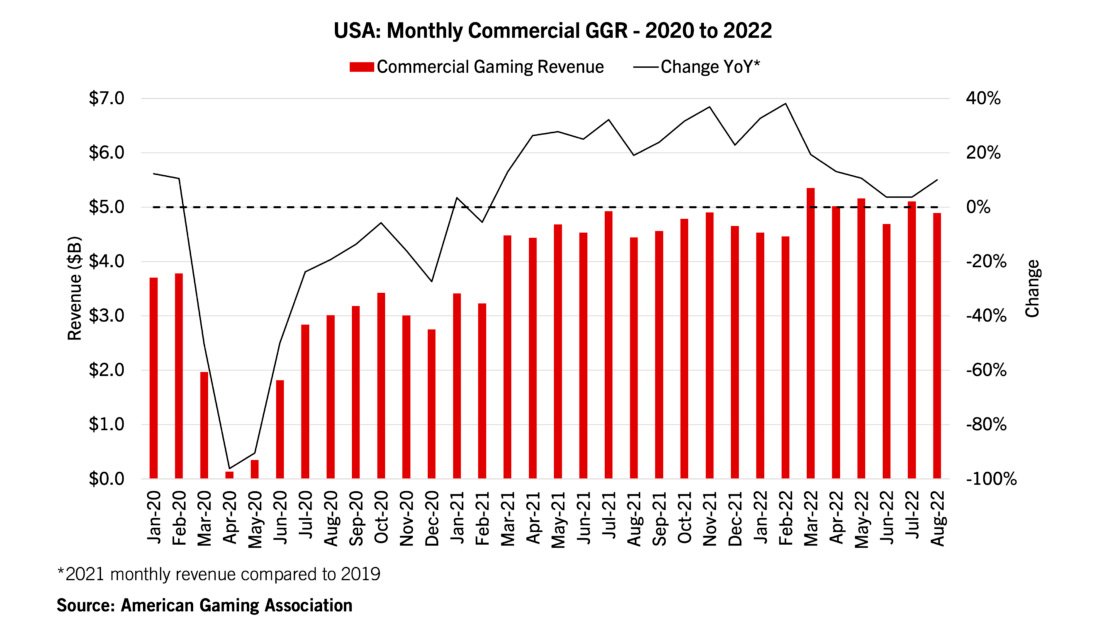

According to the American Gaming Association‘s (AGA) Commercial Gaming Revenue Tracker, U.S. commercial gaming revenue surged in August as American spending on land-based casino gaming, sports betting, and iGaming reached $4.89 billion – up 10% year-over-year and a new record for the month. Additionally, August marked the 18th consecutive month with positive year-over-year gaming revenue growth, delivered “despite difficult macroeconomic conditions.”

The AGA’s Commercial Gaming Revenue Tracker provides monthly and quarterly state-by-state and nationwide insight into the U.S. commercial gaming industry’s financial performance. The association’s report for August shows that the pace of growth year-over-year reversed in August after slowing for the past several months. Though, in line with seasonal trends, revenue declined 4.1% on a sequential basis as summer travel wound down and the fall sports calendar had not begun.

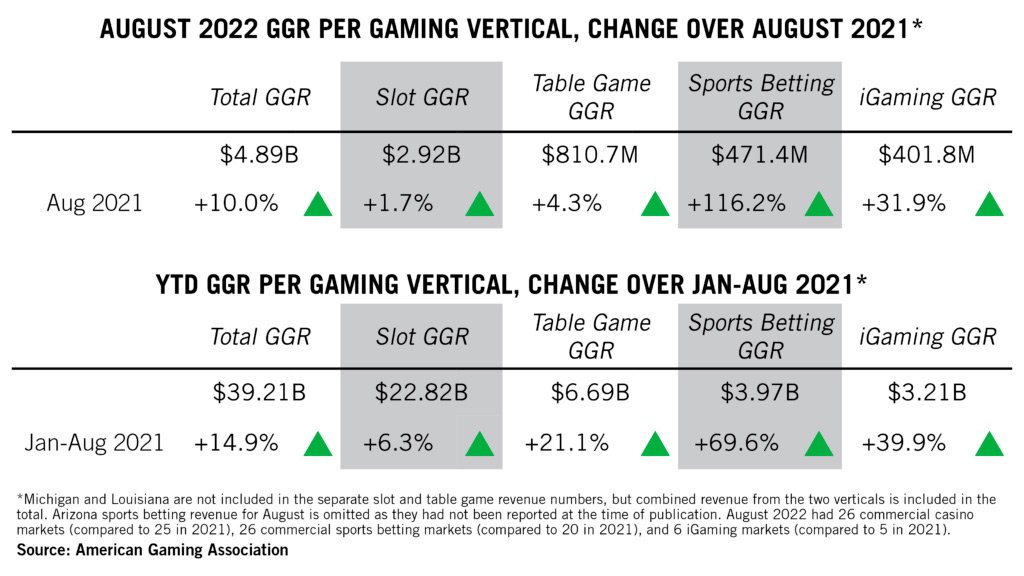

“2022 remains on track for another record-setting year. Through the first eight months of the year, commercial gaming revenue totaled $39.21 billion, 14.9% ahead of 2021,” the association’s report for August reads.

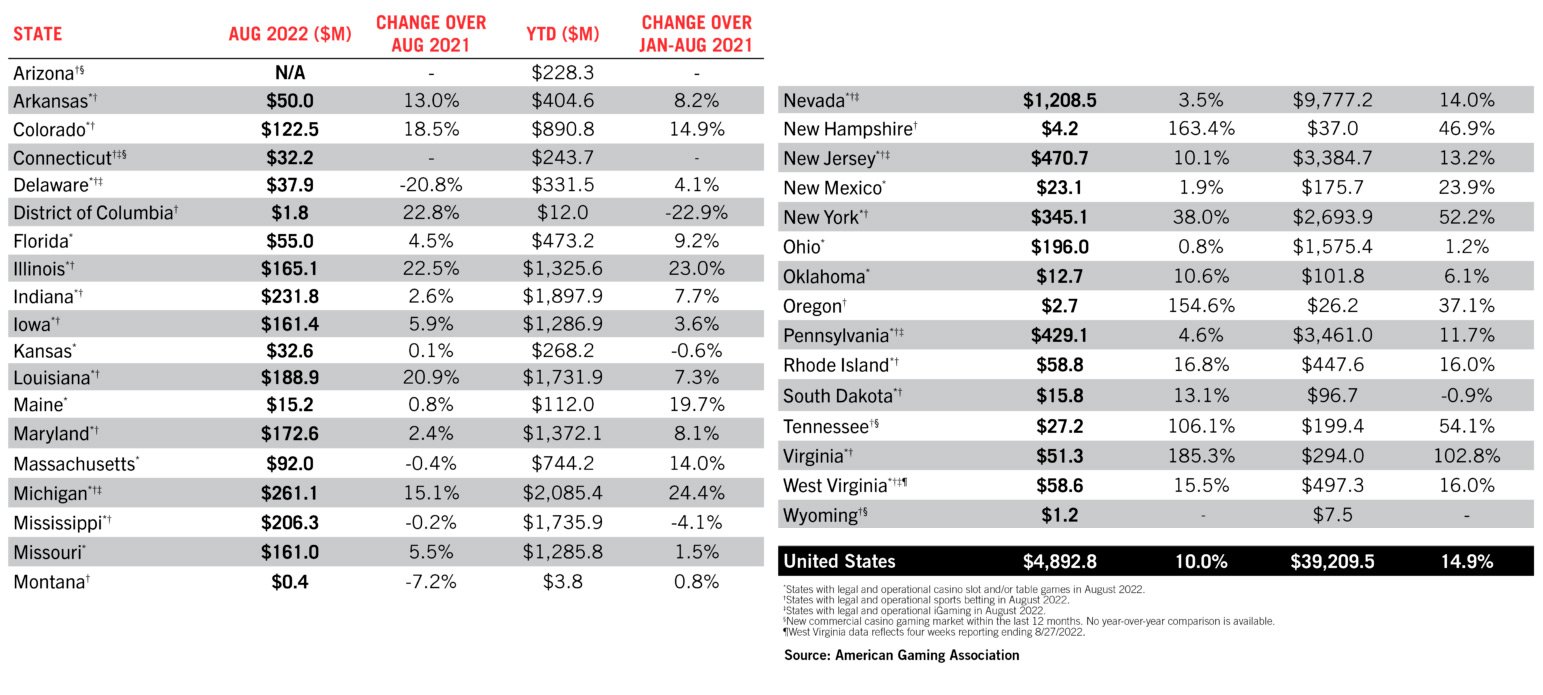

According to the Commercial Gaming Revenue Tracker, 27 of 31 commercial gaming jurisdictions that were operational a year ago saw revenue growth compared to August 2021. Monthly gaming win contracted in Delaware (-20.8%), Massachusetts (-0.4%), Mississippi (-0.2%), and the limited sports betting market of Montana (-9.1%).

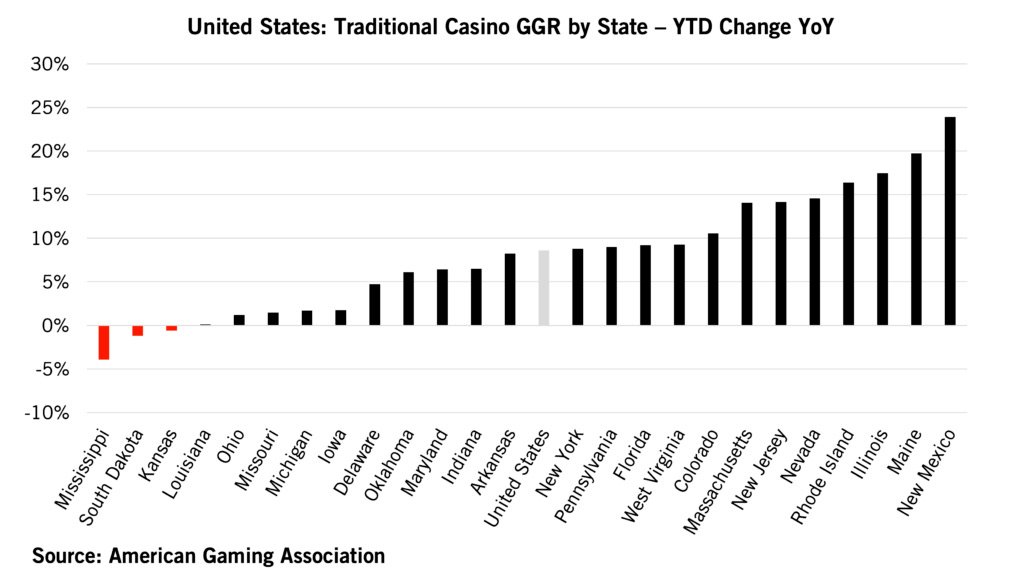

By the end of August, just four jurisdictions remained behind their gaming revenue pace compared to the same period in 2021: the District of Columbia (-22.9%), Kansas (-0.6%), Mississippi (-4.1%), and South Dakota (-0.9%). The slowdown in Kansas, Mississippi, and South Dakota largely reflects tougher-than-average comparisons as COVID restrictions in the three states were eased earlier in 2021 than they were in most other jurisdictions, says AGA.

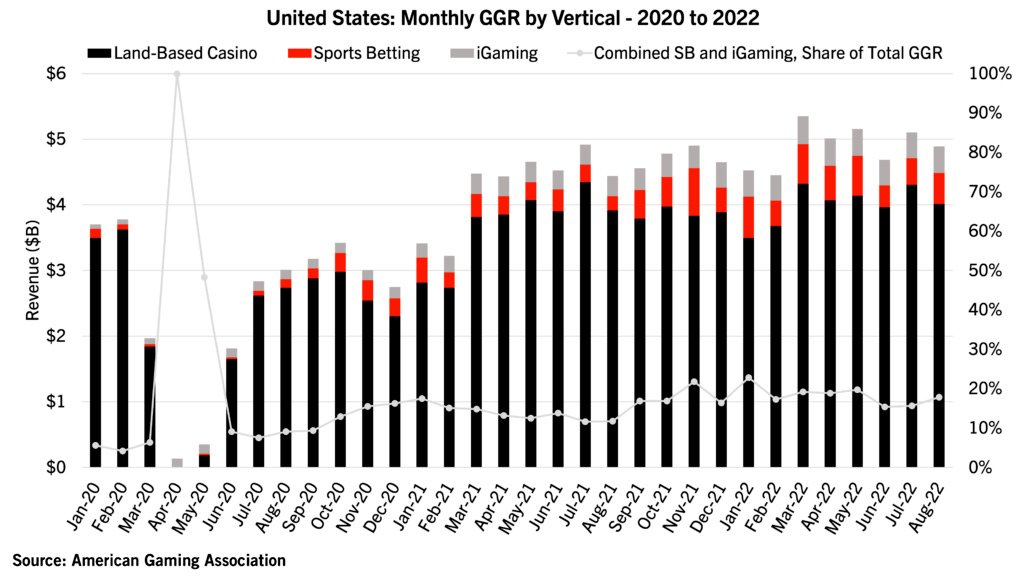

Nationwide revenue from land-based casino slot machines and table games combined for $4.02 billion in August, an increase of 2.5% over last year. Slots generated revenue of $2.92 billion, up 1.7%, while table game revenue increased 3.4% to $810.7 million. The separate slot and table game figures do not include data from Louisiana and Michigan, though their aggregates are captured by the combined nationwide figure.

While overall U.S. travel spending contracted from August 2019, the pace of revenue growth for traditional casino verticals was the highest since April. Regional casino visitation increased on average by 4.2% in Illinois, Iowa, Louisiana, Mississippi, and Missouri from 2019 levels.

August also marked the first full month of operations for land-based casino gaming in Virginia after the Commonwealth became America’s 26th casino market on July 8. The state’s first operational casino grossed $14.3 million in revenue, outpacing several similarly sized properties in nearby Maryland, Pennsylvania, and West Virginia.

Year-to-date, casino slot machines, and table games have grossed $31.96 billion, tracking 8.6% ahead of the same eight-month period in 2021. At the state level, 22 of 25 commercial gaming states with slot and table gaming in 2021 saw combined revenue from these verticals grow through the first eight months of 2022.

The emerging sports betting and iGaming verticals also had strong continued growth in August. The summer lull in the sports betting calendar limited nationwide sports betting handle to $4.54 billion, flat from the year’s lowest level of betting activity in July but still up 48.6% year-over-year.

Operators generated $471.4 million in revenue, more than doubling (116.2%) over last year on the back of continued expansion into six new states since last August and organic growth in all but two markets that were operational one year ago (Delaware, -34.5%, and Montana, -7.2%).

Through August, commercial sports betting revenue stands at $3.97 billion, up 69.6% on the same month last year, while the year-to-date handle is $55.76 billion, 86% ahead of the same period last year. According to AGA, and assuming no significant slowdown in the pace of growth between now and December, the annual sports betting handle will likely surpass the $100 billion mark this year.

Meanwhile combined August revenue generated by iGaming operations in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, and West Virginia increased by 31.9% year-over-year to $401.8 million, with all markets reporting annual growth. August 2021 had one less operational iGaming market, with Connecticut launching in October. Year-to-date iGaming revenue stands at $3.21 billion, up 39.9% in the same period in 2021.

Combined revenue from sports betting and iGaming accounted for 17.9% of total U.S. commercial gaming revenue in August, up from the two previous months.

Original article: https://www.yogonet.com/international/news/2022/10/20/64708-us-commercial-gaming-sees-bestever-august-at–49b-revenue-on-track-for-another-recordsetting-year