Luckbox operator Real Luck Group has rejected two proposals from Bragg Gaming co-founder Adam Arviv, as they were deemed “inconsistent” by the firm. One of them called to sell the business and another to wind it down.

Arviv was described by Real Luck Group as an “activist investor.” The first proposal was for a merger with a “private gambling company,” which would have valued Luckbox at CAD 0,09 per share, slightly below the CAD 0,10 per share it closed on October 27, the day in which Real Luck Group announced the rejection.

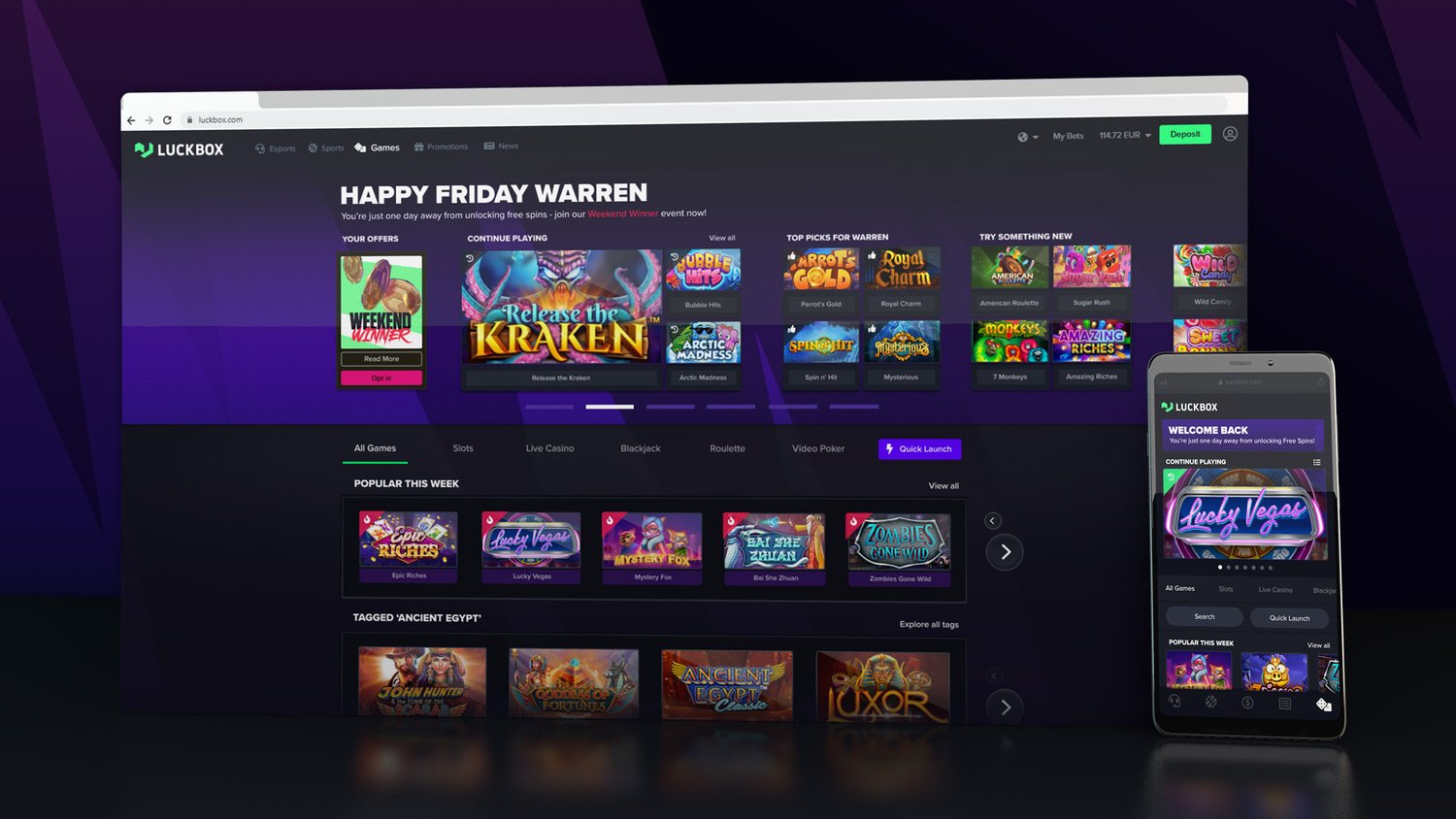

Luckbox claims that Arviv then “appeared to have changed his mind,” proposing a wind-down of Luckbox. The operator said in its proposal was “ignoring the group’s now finished platform and growing player base.” Luckbox said Arviv “appears to have recently acquired shares of the company” and has not indicated his level of ownership.

The Luckbox board stated it would not be in the best interest of the company and its shareholders to accept the proposals, as they do not reflect “the value represented by the company’s significantly growing business, and is also well below the company’s net cash position.”

Adam Arviv

“The company is undervalued. Real Luck Group has a strong cash position, no debt, and a robust plan to reach profitability and sacel in the next six-to-ten months,” the board added. “This makes the company and industry outlier and a target for individuals such as Arviv, seeking to gain access to the company’s cash, with no regard for its stakeholders. The board therefore has a duty to resist such opportunistic conduct.”

The Real Luck Group board said it retained the services of law firm McMillan LLP, and added that it was prepared to meet Arviv in his capacity as a shareholder and said it had already attempted to set up a meeting that Arviv had declined.

The Group stated it remains committed to optimizing shareholder value. “The company continues to execute on its corporate strategy as outlined in the annual general meeting of shareholders held in August 2022,” a statement highlights.

Back in September, Real Luck Group announced a growth in Key Performance Indicators (KPIs) since entering its new customer acquisition phase in August this year. According to the group, Net Gaming Revenue grew 144% during the last month and total player deposits grew by 197%.

These first data points mark “a successful” transition of the company to its next growth phase of customer acquisition, which was first communicated at Real Lucky Group’s annual general meeting on August 11. The early operational data and strong balance sheet support management guidance for profitability exiting H1 2023, the business noted.

“The initial growth since transitioning to customer acquisition gives us increased confidence that our offerings, strategy, and financial forecast are on point,’ said Real Luck Group CEO Thomas Rosander. ‘Behind this success lies our platform’s capability to localize language variations, payment methods and marketing campaigns in a granular way.”

“We have also seen increased interest for high margin, micro-betting products,” added Rosander. “This is the core of our long-term strategy, and we have invested significant effort and resources to develop the new, proprietary products that will transform the market.”

Original article: https://www.yogonet.com/international/news/2022/11/01/64857-luckbox-parent-real-luck-group-rejects-merger-and–34winddown-34-proposals-by-bragg-39s-adam-arviv