In recent years, iGaming in LATAM has experienced remarkable expansion. This growth can be attributed to advancements in technology, greater internet access, and evolving regulatory frameworks. Latin America, with its population exceeding 600 million, houses a vibrant community of passionate sports fans eager to further engage with their cherished teams and players. In its latest analytical article, sports betting and iGaming platform supplier Uplatform shares insights into the matter.

Recent reports highlight the presence of over 150 licensed sportsbooks operating in the region, providing players with a diverse range of betting options for local and international competitions. With the industry gaining traction, it becomes crucial to examine and understand the diverse elements associated with iGaming in Latin America. The objective of this editorial is to offer a thorough panorama of the present status of iGaming in the region, shedding light on the opportunities and challenges it brings forth.

Market Potential and Growth

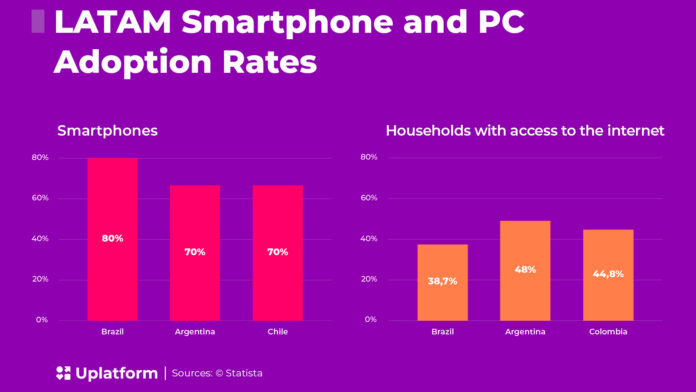

The demographics of the LATAM region, coupled with increasing internet and smartphone penetration rates, have played a significant role in the rise of iGaming. Latin America has a young and tech-savvy population that has embraced digital platforms for entertainment and leisure activities. With the increasing affordability and accessibility of internet connectivity, a growing segment of the population is gaining entry into the thriving iGaming industry.

Statistical Overview:

Revenue: The iGaming market in Latin America is projected to reach a staggering US$7.38 billion by 2027, indicating the immense potential for growth and profitability in the region.

Mobile dominance: On average, operators in Latin America generate 76% of their total online revenue through mobile applications. This statistic underlines the growing reliance on mobile devices for accessing and engaging with iGaming websites, reflecting the region’s preference for convenience and mobility.

“Latin America stands out as a region of unique diversity. Latin America differs from other regions in terms of the sports that its bettors prefer, which are European and American. With a wide variety of sports capturing the attention of customers, the landscape of sports betting in Latin America is marked by constant and diverse trends,” explains Randall, Sales Manager at Uplatform.

“Latin America stands out as a region of unique diversity. Latin America differs from other regions in terms of the sports that its bettors prefer, which are European and American. With a wide variety of sports capturing the attention of customers, the landscape of sports betting in Latin America is marked by constant and diverse trends,” explains Randall, Sales Manager at Uplatform.

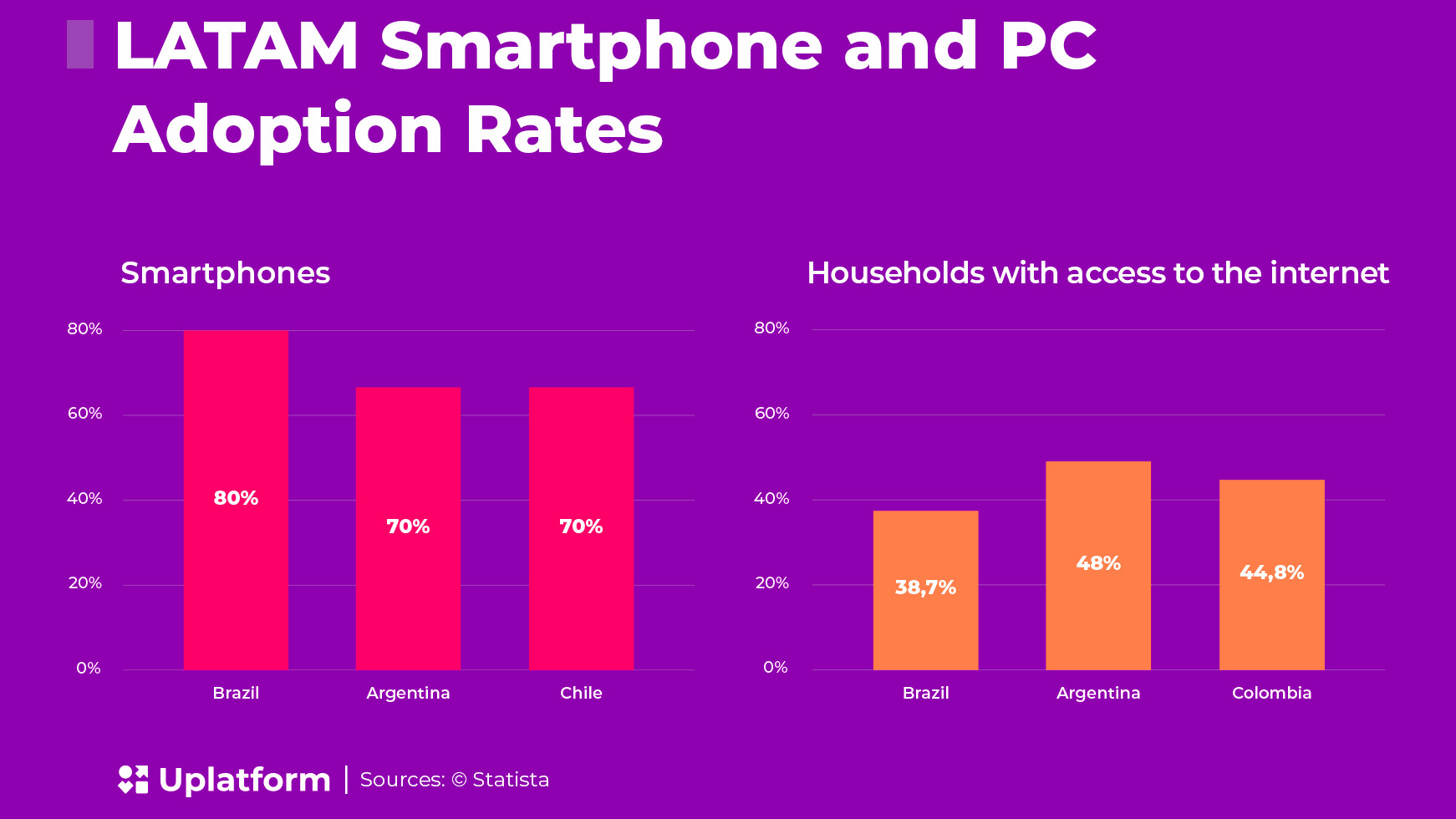

He also emphasized that bettors in LATAM now seek more than just the odds of major matches. They are seeking compelling and innovative proposals that surpass conventional offerings. Live betting has also gained significant popularity among sports bettors, providing a plethora of options for players to explore and select the wagers that resonate with them the most. In the world of casinos, players in Latin America exhibit a notable preference for slot machines and live casinos. Additionally, for the younger generations, Esports have become an essential aspect of their betting experience.

The expanding middle class in Latin America has also contributed to the growth of the iGaming industry. As disposable incomes increase, more individuals have the financial means to participate in online gambling and betting activities. The emerging middle class seeks entertainment options beyond traditional forms of betting and gambling, and online platforms provide a convenient and engaging alternative.

Changing player behaviors have had a profound impact on the growth of the iGaming industry in the region. With the advent of online betting and gambling, players can now enjoy a wide range of betting options and casino games from the comfort of their homes. Geographical restrictions or the inconvenience of going to actual iGaming establishments may have previously discouraged some people from playing, but this convenience factor has attracted a larger audience.

Furthermore, the popularity of Esports has skyrocketed in Latin America, driving the growth of the iGaming industry. The region has witnessed a surge in Esports enthusiasts, and sports betting platforms have capitalized on this trend by offering betting markets on Esports events. The combination of online gambling and Esports has created a thriving ecosystem that appeals to a younger demographic and fuels the growth of the industry.

Recognizing these trends and diverse needs, Uplatform is offering an ‘All in One’ concept. This comprehensive platform caters to the requirements of all types of bettors, providing a single destination where everything is readily available at their fingertips. No longer do bettors need to visit multiple sites; Uplatform’s All in One solution seamlessly brings together all the necessary features and services. With this groundbreaking approach, Uplatform has simplified the betting experience, offering convenience, variety, and a holistic platform that caters to the unique preferences of Latin American bettors.

Recognizing these trends and diverse needs, Uplatform is offering an ‘All in One’ concept. This comprehensive platform caters to the requirements of all types of bettors, providing a single destination where everything is readily available at their fingertips. No longer do bettors need to visit multiple sites; Uplatform’s All in One solution seamlessly brings together all the necessary features and services. With this groundbreaking approach, Uplatform has simplified the betting experience, offering convenience, variety, and a holistic platform that caters to the unique preferences of Latin American bettors.

Evolving Markets With a Big Potential

The iGaming market in Latin America shows great potential, with countries like Brazil, Argentina, and Peru leading the way. Each country in LATAM possesses its own unique characteristics and presents exciting opportunities for online casino and betting operators and providers to thrive and succeed.

Brazil

As the largest country in South America with a population of over 200 million people, Brazil offers a massive market for the iGaming industry. The country’s passion for sports, particularly football, creates a fertile ground for sports betting. With increasing internet penetration and a tech-savvy population, the iGaming sector in Brazil has the potential to experience substantial growth in the coming years.

Moreover, exciting developments are on the horizon for Brazil as the country stands on the edge of introducing new regulations in the iGaming industry. The topic of Brazil’s upcoming regulations has been the focal point of discussions and deliberations at the conference, reflecting the significant impact it is expected to have on the iGaming landscape.

Brazil-specific statistics:

Estimated GGR: For Brazil specifically, the estimated GGR is forecasted to be US$1.58 billion in 2023 and is projected to reach US$3.23 billion by 2027. These figures indicate significant growth opportunities within the Brazilian iGaming market.

Sports Betting Participation: According to the results of the TGM Sports Betting Survey conducted in Brazil in October 2022, 46.14% of the population participated in sports betting activities in the previous 12 months. The 25-34 age group emerged as the most active segment within the Brazilian market.

Gender Differences: While 45% of the male audience bet more frequently in the last 12 months compared to the previous year, an interesting finding is that 20% of women bet for the first time, surpassing the corresponding percentage for men.

Popular Sports for Betting: Football remains the most popular sport for betting in Brazil, boasting an audience of 81%. It is followed by basketball with 33% and, surprisingly, Esports with a significant audience share of 29%.

Without a doubt, Brazil holds a unique position in the iGaming landscape due to its exceptional size and significance. As the largest economy in Latin America, the decisions made by Brazil’s leadership regarding iGaming regulation have the potential to reshape how other countries approach their own legislation. Brazil’s approach and regulatory framework could serve as a powerful example, influencing and guiding other nations as they navigate the path to regulating the dynamic iGaming industry.

Argentina

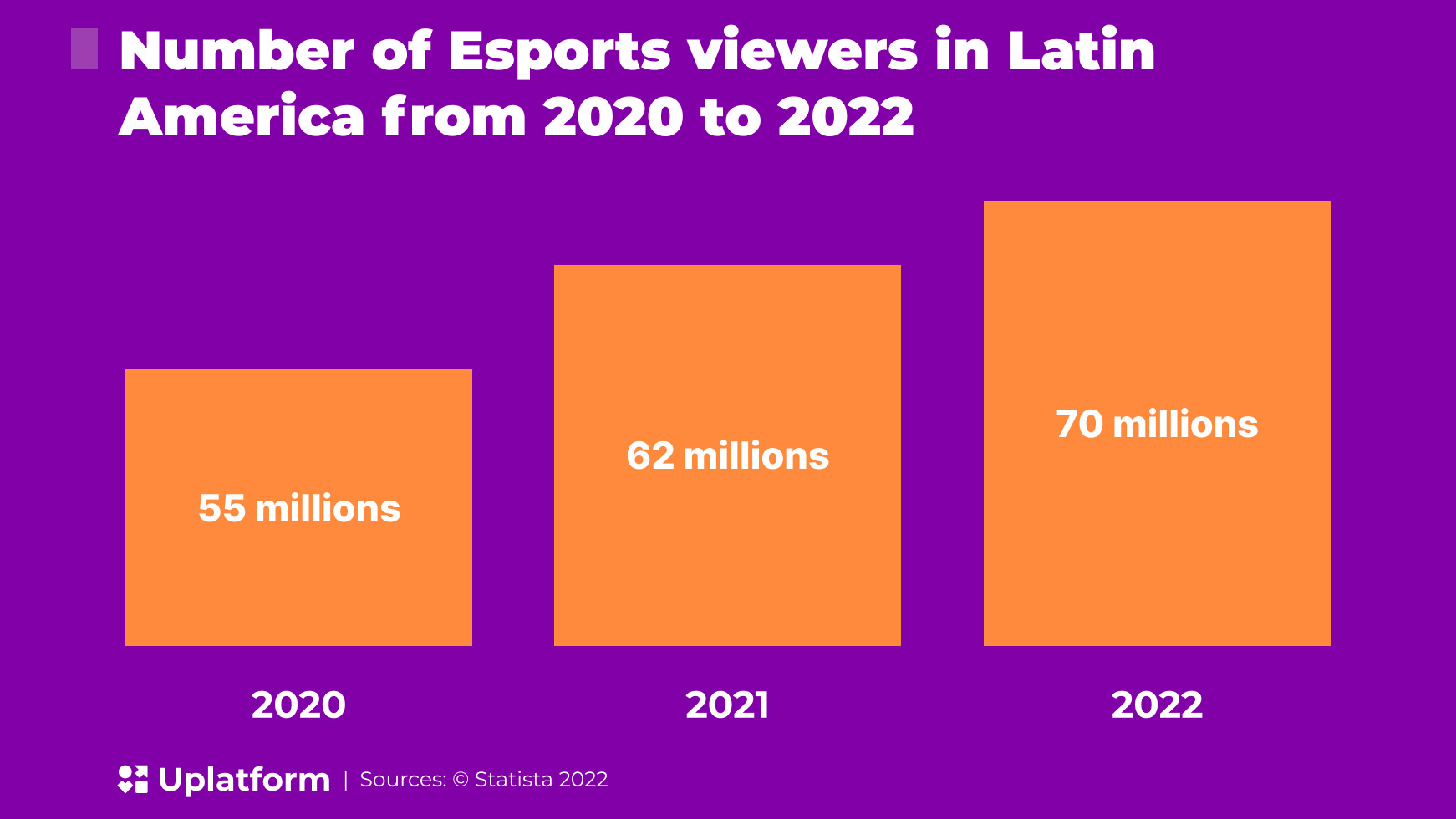

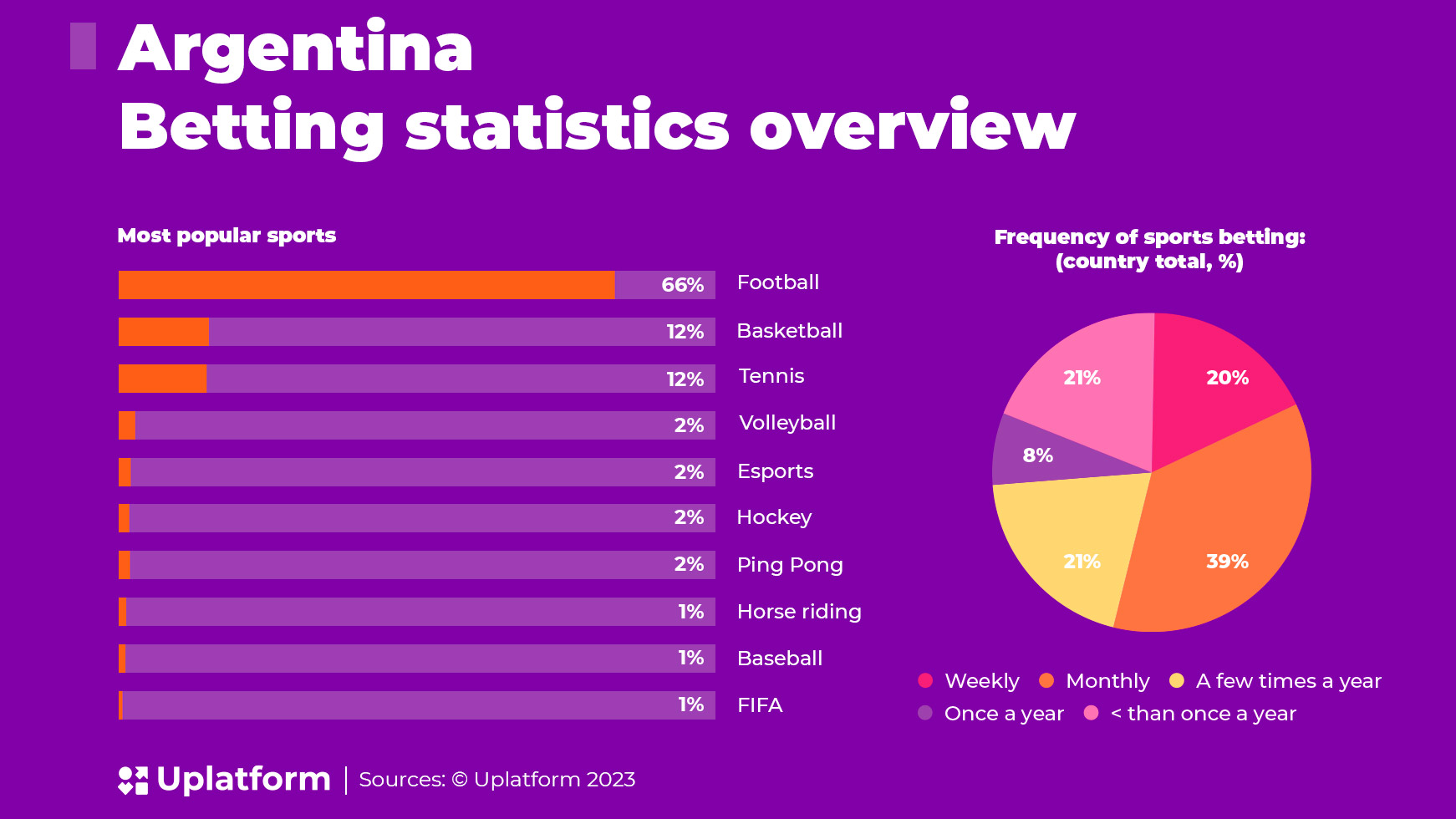

Argentina, with its recent victory in the 2022 World Cup, has a market with tremendous potential in the iGaming industry. The country’s passion for football and the national team’s success in the tournament has further fueled the interest in sports and betting.

Statistics overview:

Estimated GGR: In Argentina, the estimated GGR for 2023 is projected to be US$1.18 billion. The revenue is expected to exhibit an annual growth rate (CAGR 2023-2027) of 11.45%. This growth trajectory indicates a promising market outlook, with a projected market volume of US$1.83 billion by 2027.

Revenue Distribution: 95% of the revenue generated from online gambling will be given to the country’s provinces. The remaining percentage will likely be allocated to the federal government for oversight and regulation purposes.

iGaming Sector: Online gambling and betting are experiencing significant growth in Argentina and is considered a homegrown industry. The sector is generating substantial revenue, contributing to the country’s overall economy. The federal government has limited regulations in place for the iGaming sector, allowing it to flourish.

With a population of approximately 45 million people, Argentina offers a sizable player base for the iGaming sector. The evolving regulatory landscape, coupled with increasing internet penetration and a growing middle class, creates an environment conducive to the growth of iGaming. As regulations continue to develop and align at the national level, Argentina presents an attractive market for online gambling and betting operators to tap into and cater to the enthusiastic sports and betting audience.

With a population of approximately 45 million people, Argentina offers a sizable player base for the iGaming sector. The evolving regulatory landscape, coupled with increasing internet penetration and a growing middle class, creates an environment conducive to the growth of iGaming. As regulations continue to develop and align at the national level, Argentina presents an attractive market for online gambling and betting operators to tap into and cater to the enthusiastic sports and betting audience.

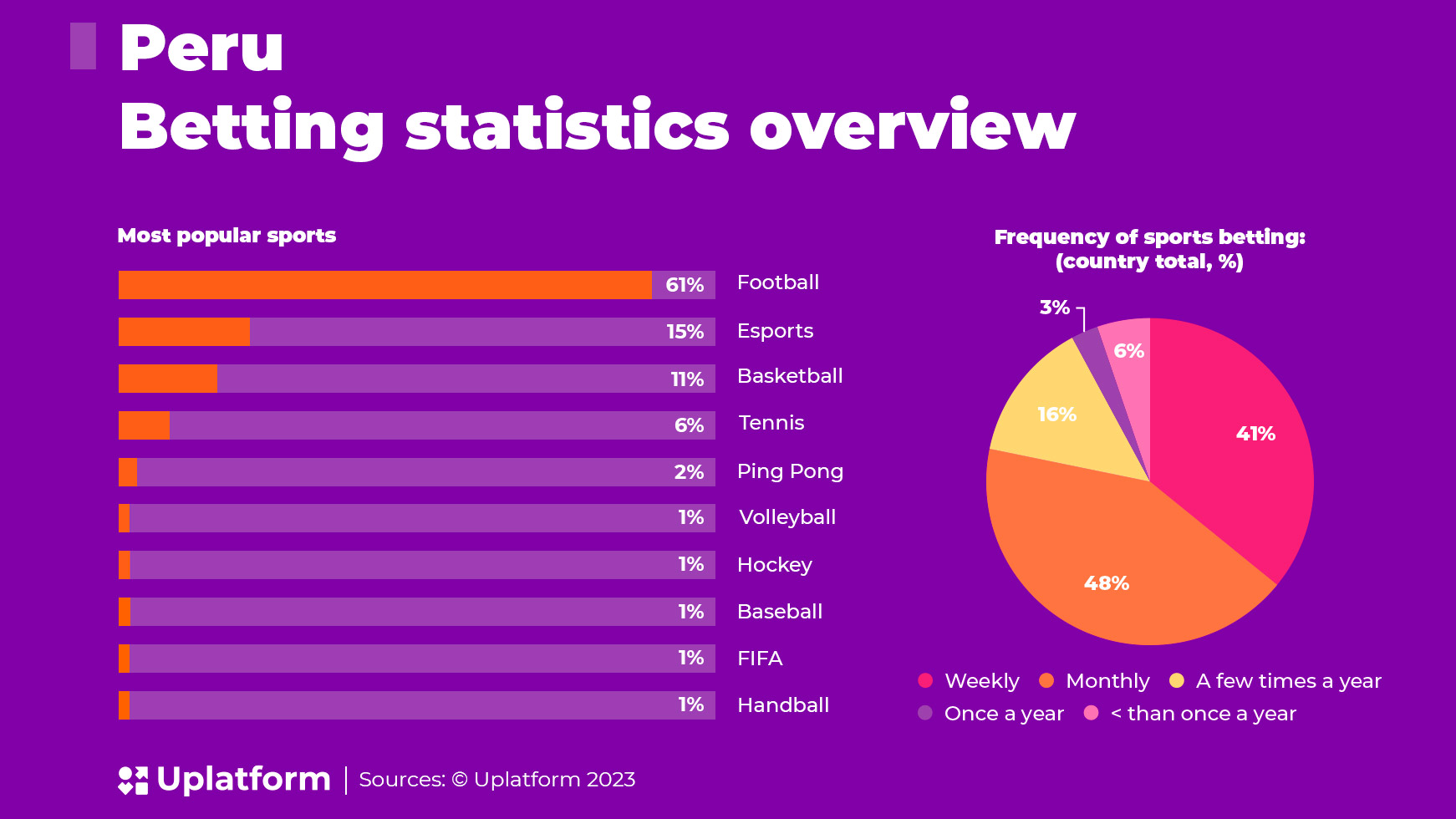

Peru

Peru has emerged as a promising market in the iGaming industry. The country has experienced steady economic growth, an expanding middle class, and increasing disposable income, which translates into greater demand for leisure and entertainment activities, including online betting. Peru’s strong sporting culture, with a focus on football and other popular sports like volleyball, contributes to the demand for sports betting.

Statistical Overview

Revenue: The estimated revenue for Peru in 2023 is US$277.00 million. It is projected to show an annual growth rate (CAGR 2023-2027) of 8.68%, resulting in a projected market volume of US$386.40 million by 2027.

TGM Research Findings: According to TGM Research, several key statistics highlight the gambling and betting landscape in Peru:

Sports Betting: In the previous 12 months, 58.8% of the population in Peru has placed a bet on a sporting event. Furthermore, 32.9% of the population has attended sporting events with bets placed online or through apps, focusing on popular sports like football and horse racing.

Lottery and Games of Chance: Approximately 31.3% of the population in Peru engages in playing the lottery or games of chance, which includes popular games like Powerball and Bingo.

Other Forms of Gambling: Around 28.4% of the population in Peru participates in other forms of gambling, indicating a diverse gambling landscape in the country.

iGaming Sector: Experts anticipate significant growth in the online gaming sector in Peru. By 2027, it is projected that there will be 723,010,000 participants in the iGaming sector. Currently, 1.7% of Internet users in Peru are actively engaged in iGaming, and this number is expected to climb to 2.1% by 2027, reflecting an increasing interest and participation in online gambling and betting activities.

The popularity of the iGaming business is rising, and the country offers opportunities for both domestic and international operators. With a population of approximately 33 million people, Peru presents a market with growth potential and a receptive audience for online gambling offerings.

The popularity of the iGaming business is rising, and the country offers opportunities for both domestic and international operators. With a population of approximately 33 million people, Peru presents a market with growth potential and a receptive audience for online gambling offerings.

Socioeconomic Impact

The socioeconomic impact of iGaming in LATAM can be substantial, as the industry has the potential to generate employment opportunities, attract foreign investments, and contribute to the region’s economic development. However, it is crucial to balance these benefits with responsible iGaming measures to ensure player protection and mitigate potential social issues.

The growth of iGaming can create diverse job opportunities in sectors like software development, user support, marketing, data analysis, and regulatory compliance. This expansion provides employment prospects for local talent, reducing unemployment rates and driving economic growth.

LATAM can attract foreign investments as the iGaming market expands and regulations become clearer. These investments bring capital infusion, technology transfer, and expertise, benefiting local economies and fostering related industries’ growth. The industry’s growth contributes to economic development by generating tax revenues that can be invested in infrastructure, public services, and social welfare programs.

To mitigate potential social issues, responsible gambling measures are necessary. Strict age verification, self-exclusion programs, responsible advertising guidelines, and education initiatives promote player protection and healthy iGaming habits. Collaboration among regulators, LATAM sportsbook providers, and stakeholders is crucial for effective implementation.

Regulations

The iGaming regulations in Latin America vary from country to country, with some nations taking a more progressive approach while others have stricter laws or outdated regulations. Argentina is known for having the most complex set of regulations, with each province having the authority to decide on the legalization and forms of iGaming. Buenos Aires is an important province that has started the process of selecting operators for online gambling.

Brazil has recently undergone amendments to its gambling and betting laws, allowing for the privatization of sports betting and state-run lotteries. The number of LATAM sports betting operators in other iGaming sectors has been limited. Brazil has a large population and a strong passion for football, making it an attractive market for operators.

Mexico is seen as an ideal market for an online casino and sportsbook due to its population, mobile penetration, and economy. Most forms of iGaming in Mexico are regulated, with the Federal Raffles and Gaming Law of 1947 serving as the governing legislation. While there may be some confusion about the laws, online betting is covered, and guidelines for operating game betting are available. However, certain iGaming bonuses and promotions are discouraged under the legal framework.

Colombia has emerged as a significant market for online betting and gambling, being the first country in Latin America to regulate it. Both land-based and iGaming are legal in Colombia, except for online horse racing betting. The industry has experienced steady growth, with contributions to the national treasury increasing and projected net iGaming revenue reaching significant amounts. Uruguay also has relatively straightforward iGaming laws, with only one authorized site offering sports betting. However, online casinos are prohibited, leading many Uruguayans to gamble on offshore websites using VPNs.

Latin America’s iGaming legislation varies across countries, but there is a trend toward increased regulation and legalization. The region represents a strategic emerging market for the iGaming industry, with a large population and growing smartphone penetration. As more countries establish legislation and regulations, the iGaming industry in LATAM is expected to grow significantly.

Conclusion

Latin America presents significant opportunities for the iGaming industry. In recent years, operators have increasingly recognized the potential of the Latin American iGaming market. With a population of over 600 million and projected high smartphone penetration, reaching 73% by 2025, the region is emerging as a strategically important market for the iGaming industry.

As operators seek to leverage new business opportunities in Latin America, it is crucial to address the challenges posed by complex regulations and market dynamics. Expert assistance can play a vital role in navigating these challenges and achieving success in the region.

If operators are interested in breaking into the Latin American market, they can consider contacting Uplatform. Their comprehensive platform encompasses three key units: Usports, a sportsbook offering traditional sports and Esports feed within a sportsbook iframe; Ucasino, an online casino games portfolio tailored to specific requirements for optimal operation success; and Utools, a suite of technical solutions essential for managing, analyzing, and nurturing business growth.

Leveraging their wealth of practical expertise, extensive practical localization issue-solving, and meticulous data analysis, Uplatform offers a comprehensive range of tailored sportsbook solutions that effectively cater to the unique demands of the LATAM market. The dedicated team at Uplatform is readily available to support operators in setting up and enhancing their online casino or sportsbook presence in LATAM, enabling them to tap into the flourishing iGaming market of the region.

Original article: https://www.yogonet.com/international/news/2023/06/13/67499-uplatform-analysis-unlocking-latam-39s-igaming-potential