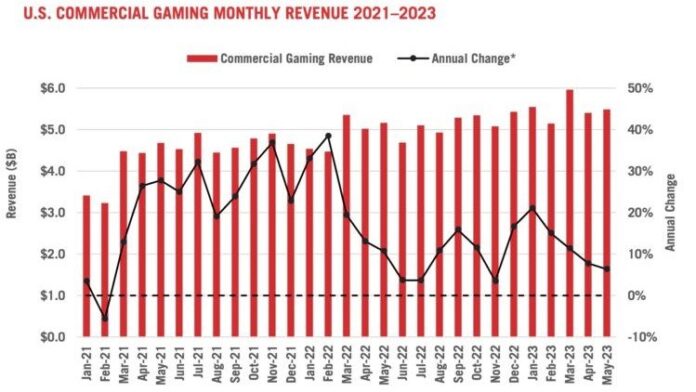

The United State’s commercial gaming industry revenue has grown more than 6% in May 2023 compared to the previous year, reaching $5.49 billion, according to state regulatory data compiled by the American Gaming Association (AGA).

While this marked the 27th consecutive month of annual national growth, the strength of state market performances has begun to diverge in the face of annual comparisons that are no longer impacted by past COVID concerns.

Through the first five months of 2023, commercial gaming revenue is tracking 12.4 % ahead of last year’s record-setting pace, reaching a total of $27.59 billion through May and on pace to reach a new historic high.

While the annual growth rate remained healthy in May, the pace of revenue acceleration slowed for a fourth consecutive month, reflecting the end of COVID-related impacts on year-over-year growth measures.

As land-based gaming revenue growth contracted slightly in May, overall growth was primarily fueled by the ongoing expansion and acceleration of online gaming. Revenue from land-based gaming, which encompasses casino slots, table games and retail sports betting, declined slightly (-0.6%) compared to the previous year.

Conversely, revenue from online gaming grew 43.4% year-over-year. This growth was driven largely by the introduction of online sports betting in Kansas, Maryland, Massachusetts and Ohio within the past year, as well as the continued growth of iGaming in the six states where it is legal.

At the state level, 24 out of 33 commercial gaming jurisdictions that were operational last year reported annual revenue gains in May. Nine states – Delaware, Florida, Iowa, Indiana, Louisiana, Missouri, Missouri, Nevada and Oregon – experienced declines in overall revenue, primarily due to slowdowns in the traditional casino segment, and as a result of lower sports betting revenue in Delaware, Mississippi and Oregon.

Although their growth has decelerated nationwide compared to digital offerings, traditional casino slot machines and table games remain the dominant engine of commercial gaming revenue.

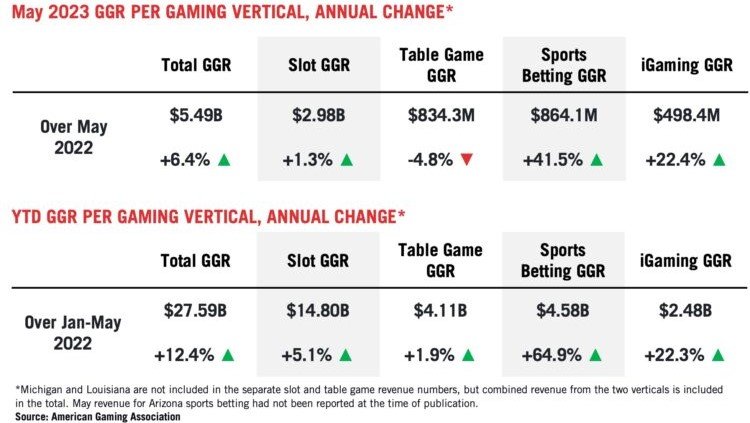

In May, these segments accumulated a total revenue of $4.12 billion, a slight decrease of 0.3% compared to the previous year. Slot machines generated $2.98 billion in revenue, up 1.3 %, while table game revenue declined 4.8 % to $834.3 million.

The individual slot and table game figures do not include data from Louisiana and Michigan due to state reporting differences, though their aggregates are captured by the combined nationwide figure.

Year-to-date through May, the combined revenue from casino slot machines and table games reached $20.50 billion, surpassing last year’s pace by 4.1 %. At the state level, 19 out of 25 commercial gaming states that offered these gaming options in 2022 posted year-to-date revenue growth in these segments through May.

Revenue from sports betting and iGaming continued to expand, with both verticals reporting the best May revenue levels ever.

Land-based and online sportsbooks collectively generated $864.1 million in commercial revenue across 28 jurisdictions (excluding Arizona, which had not reported May figures at the time of publication). This marks an increase of 41.5 % from May 2022 when commercial sports betting markets were active in 26 jurisdictions.

Adults in 24 jurisdictions had the option to place bets online, including in four states that launched mobile sports betting offerings within the past year: Kansas, Maryland, Massachusetts and Ohio.

Excluding the impact of new sports betting markets and online expansions, sports betting revenue grew 24.2 % compared to May 2022. Notably, Ohio and Massachusetts, two of the newest markets, solidified their positions among the five highest-grossing sports betting states in May.

Through May, year-to-date commercial sports betting revenue reached $4.58 billion, exceeding the same period in the previous year by 64.9 %.

Finally, the combined revenue from iGaming operations in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia grew 22.4% year-over-year in May, reaching $497.4 million.

All six markets reported annual iGaming revenue growth. Year-to-date iGaming revenue stands at $2.48 billion, reflecting an increase of 22.3 % compared to the same period in 2022.

Original article: https://www.yogonet.com/international/news/2023/07/25/68038-us-commercial-gaming-sees-6-revenue-growth-in-may-driven-by-sports-betting-and-igaming