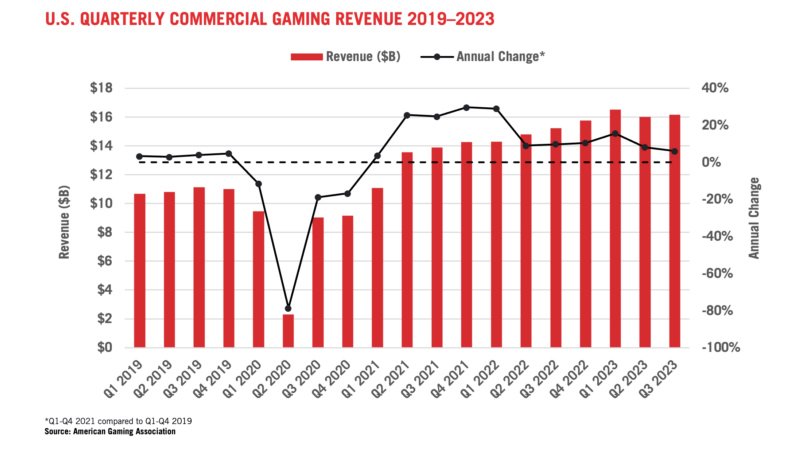

The commercial gaming industry in the United States experienced its most successful third quarter to date, generating a record-breaking revenue of $16.17 billion. This also marks the eleventh consecutive quarter of year-over-year (YoY) growth.

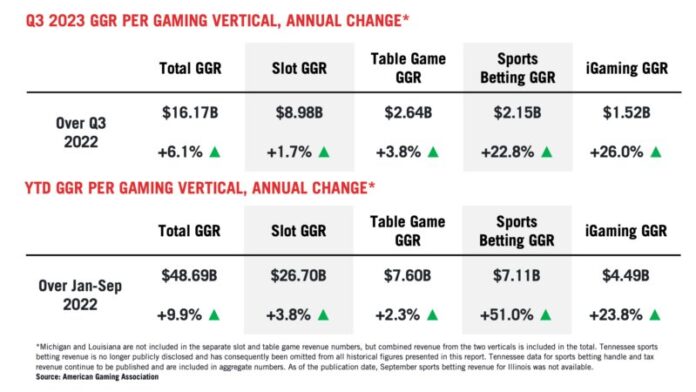

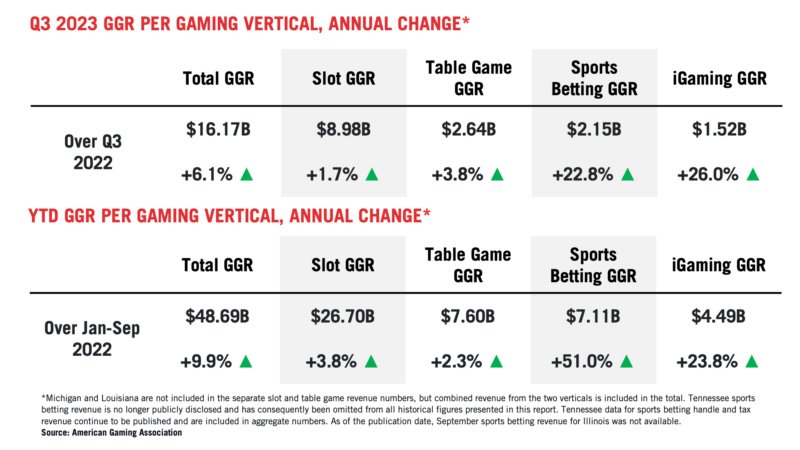

As per American Gaming Association’s Commercial Gaming Revenue Tracker, U.S. commercial gaming revenue grew by 6.1 percent in the third quarter of 2023. Total revenue for the first nine months of 2023 stands at $48.69 billion, 9.9 percent higher than the same period in 2022. Even with potential softer Q4 revenue this year, 2023 is poised to become the third consecutive record-breaking year for the commercial gaming industry.

Quarterly gaming revenue grew across all verticals, with single-quarter revenue records across both land-based and online casino gaming verticals.

Revenue growth in total land-based gaming—encompassing casino slots, table games and retail sports betting—accelerated from 0.9 percent in the previous quarter to 1.5 percent in Q3, reaching a total of $12.61 billion. Simultaneously, the annual revenue gains for total online gaming—iGaming and online sports betting—slowed to 26.9 percent in Q3 from 44.4 percent in Q2. Combined revenue from online sports betting and iGaming totaled $3.52 billion, accounting for 21.8 percent of total commercial gaming revenue in Q3 – the lowest share since Q3 2022.

Kentucky is the only new market opened during the quarter, though the state has not yet released any revenue data.

Commercial gaming operators paid an estimated $3.43 billion in taxes tied directly to gaming revenue, an increase of 4.7 percent YoY. The industry has paid approximately $10.68 billion in gaming taxes during the first nine months, 9.9 percent more than the same period in 2022.

In Nevada, gaming revenue grew 2.9 percent YoY, reaching $3.88 billion, propelled by a record-breaking quarter for Strip casinos ($741.2 million) and the highest Baccarat win in state history: $458.4 million, a 50.1 percent increase from last year.

New Jersey’s highest-ever gaming win of $1.56 billion, up 8.6 percent year-over-year, came as the state noted new quarterly highs for both iGaming ($469.6 million) and sports betting ($268.2 million), while Atlantic City casinos experienced their second-best quarter ever for land-based slot machines and table games ($816.8 million).

Among states with year-over-year quarterly declines, most states saw low single-digit percentage drops while the sports betting-only markets of Montana (-6.9%), New Hampshire (-18.7%) and Washington, D.C. (-33.2%) experienced the sharpest declines.

Looking ahead to full-year results, most states are poised to exceed their 2022 revenue totals. Year-to-date, seven jurisdictions remained flat or experienced changes of less than one percent compared to 2022. Three jurisdictions—Indiana (-2.0%), Mississippi (-3.5%) and Washington, D.C. (-11.1%)—trailed last year’s pace through September more significantly.

At the property level, Resorts World NYC was the leading revenue generating property outside of Nevada while the Borgata moved ahead of MGM National Harbor to become the second highest-grossing casino for the quarter. Other noteworthy changes include Hard Rock Atlantic City (up to 6 from 10), Southland (AR) (19 from 22) and Hollywood at Charles Town (WV) (18 from 21).

In the third quarter, traditional brick-and-mortar casino gaming revenue grew 1.8 percent YoY to $12.49 billion, surpassing the previous high of $12.30 billion in Q1 2023, with July setting a single-monthly record with $4.40 billion. Both slot and table revenue set individual quarterly records in Q3, with casino slot machine revenue growing by 1.7 percent to $8.98 billion and table games growing 3.8 percent to $2.64 billion.

The pace of sports betting expansion slowed compared to Q2 due to a slower sports calendar. Despite this, quarterly sports wagering revenue reached $2.15 billion, a 22.8 percent annual increase over the same period last year. Nearly all of this growth comes from the $358.7 million in sportsbook winnings in Maryland (online expansion), Massachusetts, Nebraska (retail only) and Ohio – markets that were not operational one year ago. Excluding these new markets, Q3 2023 sports betting revenue was up 2.7 percent year-over-year.

Americans bet $23.02 billion on sports in the third quarter, 32.7 percent more than the previous year.

Through September, commercial sports betting remains on a track for another record-setting year. Revenue reached $7.11 billion through the first nine months, 51.0 percent higher than the same period last year and nearly matching the full-year 2022 revenue of $7.18 billion. Year-to-date handle stands at $78.67 billion, a 22.9 percent annual increase.

The iGaming vertical recorded $1.52 billion in third-quarter revenue, up 22.6 percent compared to Q3 2022 and a new single-quarter record. At the state level, iGaming set new quarterly revenue records in Connecticut, New Jersey, and Pennsylvania. After three strong quarters, iGaming is on track for another record year with year-to-date revenue of $4.49 billion, 23.8 percent ahead of the same period last year.