Betr announced it has closed $15 million in strategic equity financing from a group of investors at a $375 million valuation, bringing its total funding to date to $100 million. This round of financing comes off a “highly successful 2023” for Betr, according to the sports betting operator, which says it reached a significant level of scale, both concerning paying users and revenue, over the 12-month period.

The round was co-led by Harmony Partners and 10x Capital, with participation from the company’s three largest existing investors: Fuel Venture Capital, Aliya Capital Partners, and Roger Ehrenberg/Eberg Capital, among others.

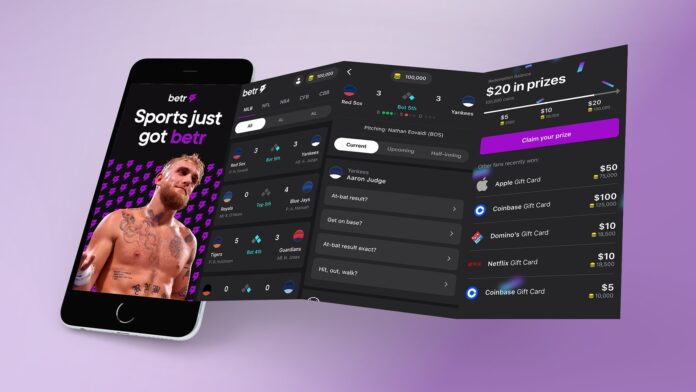

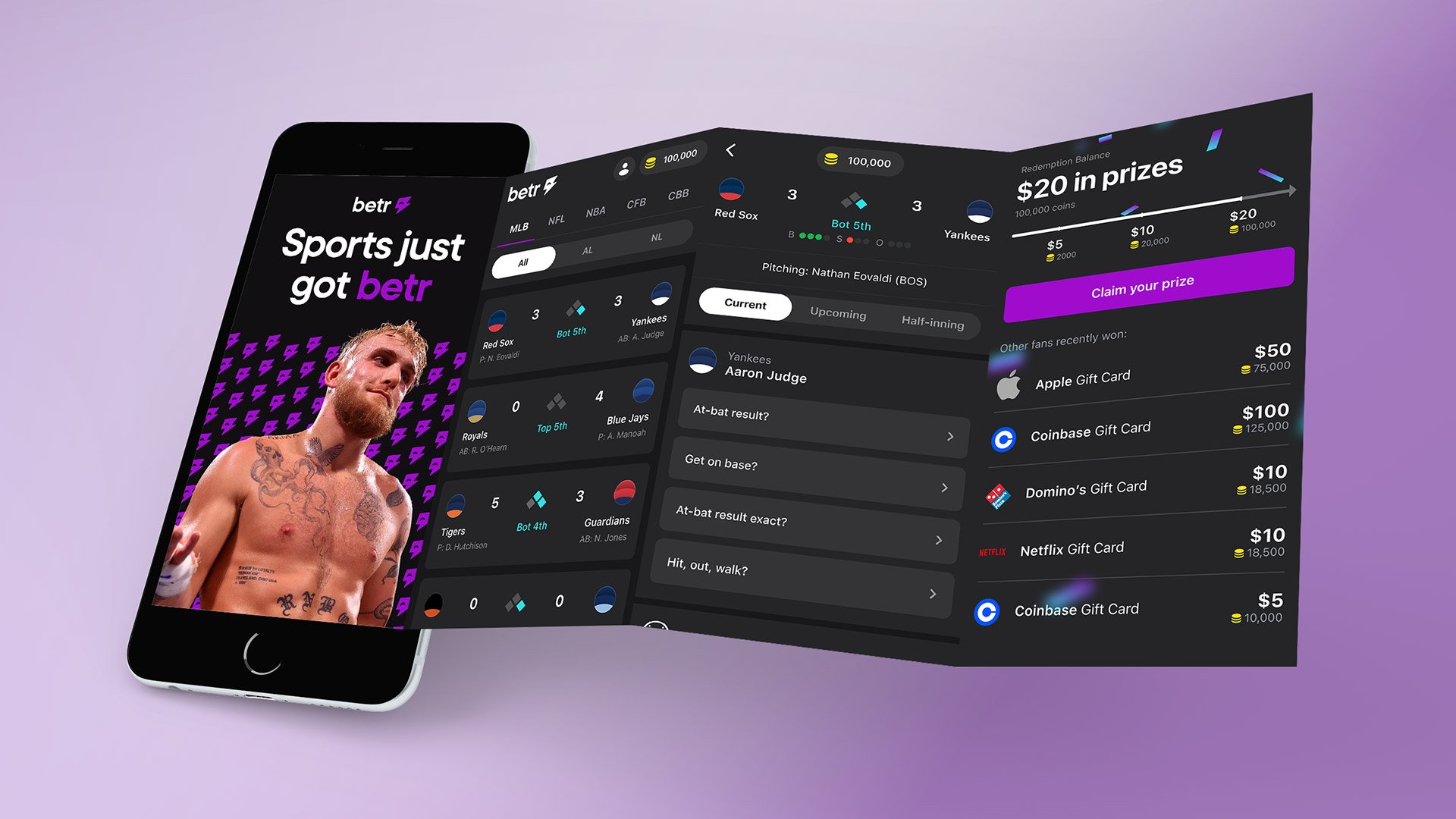

Betr recently announced market access expansion plans for its online sportsbook product, having secured market access in Pennsylvania, Ohio, Virginia, Indiana, Colorado, and Kentucky, as well as the upcoming launch of its Casino product (pending regulatory approval), with the company also securing iGaming market access in Pennsylvania. Betr has also officially received its temporary Indiana sports wagering license from the Indiana Gaming Commission in recent weeks.

Betr also recently announced that it has expanded its senior leadership team with the hiring of Dan Maas as Head of Media Revenue, Partnerships, and Strategy and Andrew Winchell as Head of Government Affairs.

Maas will lead monetization efforts for Betr Media, seeking to position Betr’s media arm to become “a large bona fide revenue-generating business” – in addition to the primary benefit Betr Media serves, which is to create customer acquisition economics for Betr Gaming. Meanwhile, Winchell will strengthen Betr’s internal government and regulatory affairs capabilities as the company scales in size and launches in new jurisdictions.

Maas joins Betr from Wave Sports & Entertainment, where he worked his way up from VP of Partnerships to EVP of Commercial and oversaw the development and monetization of franchises including New Heights with Travis and Jason Kelce and Podcast P with Paul George, in addition to leading the monetization of their original short-form video-focused social media content strategy, which are both “highly synergistic” to the core pillars of Betr Media.

Meanwhile, Winchell joins Betr from FanDuel, where he served as their Directory of Regulatory Affairs. He brings a breadth of experience working closely with state regulators and political leaders on key issues about sports gaming, the company says.

Joey Levy

“We are thrilled to announce our strategic equity financing, new members of our senior leadership team, and the approval of our temporary Indiana sports wagering license,” said Joey Levy, Founder and CEO of Betr.

“Jake (Paul) and I co-founded Betr just over two years ago, so raising capital from leading growth stage investors at a $375 million valuation in the very early days of our business is a testament to the performance of the team and business to date, and the potential we have to build a category-defining business with Betr.”

“Finally, I want to thank the Indiana Gaming Commission for the honor and privilege of a sports wagering license in the Hoosier state. We are excited to launch our new V1 Sportsbook product in Indiana over the coming months while bringing our best-in-class responsible gaming standards to the state,” he added.

“We believe that Betr has the product, management, and market opportunity that we saw in DraftKings in its early days with a significantly larger TAM and room for growth today,” said David Weisburd, Co-Founder and Head of Venture Capital at 10x Capital.

Original article: https://www.yogonet.com/international/noticias/2024/03/07/71152-betr-raises-15m-in-strategic-equity-financing-to-boost-its-sports-gaming-and-media-businesses