Casinos and sports betting operators in the state of Massachusetts have collectively generated $128.41 million of taxable gaming revenue in the month of July 2023. This figure marks a slight decrease of about 3% from the previous month of June, where the revenue had reached slightly over $132 million.

As per the Massachusetts Gaming Commission, the three casinos in the state — Plainridge Park Casino (PPC), MGM Springfield (MGM), and Encore Boston Harbor (EBH) generated approximately $99 million in Gross Gaming Revenue (GGR) in July while approximately $29.41 million in taxable sports wagering revenue (TSWR) was generated across the eight mobile/online sports wagering licensees and the three in-person licensees for the month of July.

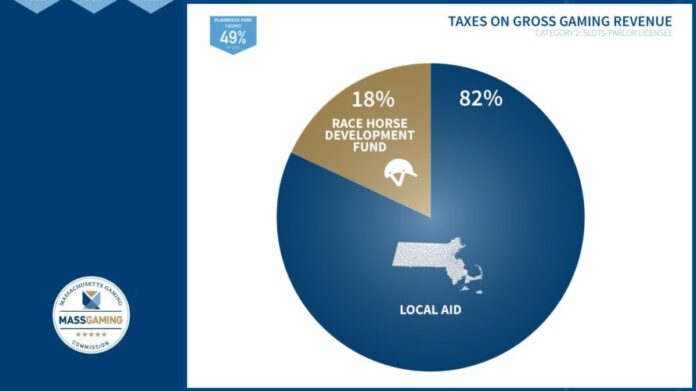

PPC, classified as a category 2 slots facility, is taxed on a 49% tax GGR. Of the total taxed amount, 82% was allocated to Local Aid, with the remaining 18% designated for the Race Horse Development Fund. Both MGM Springfield and Encore Boston Harbor, classified as category 1 resort casinos, are taxed on 25% GGR. These funds were then distributed to various state funds as specified by the gaming statute.

To date, the Commonwealth has collected approximately $1.487 billion in total taxes and assessments from the casino operations of PPC, MGM, and Encore since the respective openings of each gaming facility.

EBH, MGM, and PPC are licensed as Category 1 Sports Wagering Operators, which allows them to operate a retail sportsbook at their respective property. Category 1 operators are taxed on 15% of TSWR.

Barstool Sportsbook, BetMGM, Betr, Caesars Sportsbook, DraftKings, Fanatics Betting & Gaming, FanDuel, and WynnBet are licensed as Category 3 Sports Wagering Operators, which allows them to operate a mobile or online sportsbook. Category 3 operators are taxed on 20% of TWSR.

Of the total taxed amount for all operators, 45% is allotted to the General Fund, 17.5% to the Workforce Investment Trust Fund, 27.5% to the Gaming Local Aid Fund, 1% to the Youth Development and Achievement Fund, and 9% to the Public Health Trust Fund.

The Commonwealth has collected approximately $45.81 million in total taxes and assessments from the sports wagering operations of licensed operators since sports wagering began in person on January 31, 2023 and online on March 10, 2023.

When an operator’s adjusted gross sports wagering receipts for a month is a negative number because the winnings paid to wagerers and excise taxes paid pursuant to federal law exceed the operator’s total gross receipts from sports wagering, the Sports Wagering Law allows the operator to carry over the negative amount in tax liability to returns filed for subsequent months.

Original article: https://www.yogonet.com/international/noticias/2023/08/16/68351-massachusetts-casinos-and-sports-betting-generate-12841-million-in-july-marking-3-dip-from-june